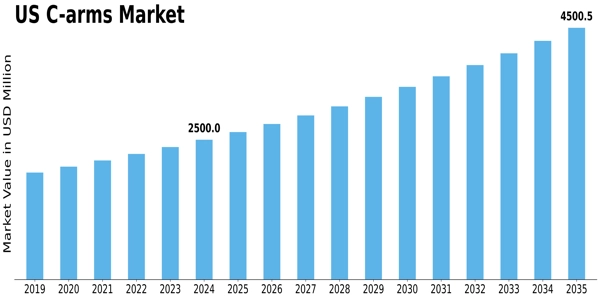

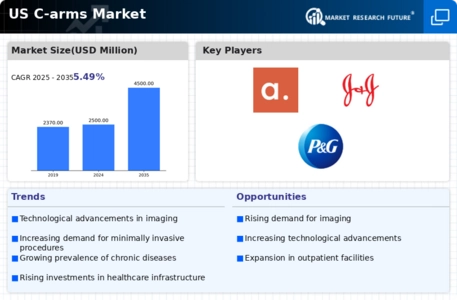

Us C Arms Size

US C arms Market Growth Projections and Opportunities

The US C-arms market is influenced by a myriad of market factors that collectively shape its dynamics. One crucial factor is technological advancements. As medical imaging technology evolves, the demand for more sophisticated C-arm systems increases. The integration of features like 3D imaging, improved image resolution, and real-time data processing plays a pivotal role in attracting healthcare providers to upgrade their existing equipment. Furthermore, another substantial market factor is the surfacing rate of chronic diseases and the growing population of old people. Since there is a sizeable population of people that need the diagnostic and interventional procedures, dependency on all types of medical C-arms, including C-arms needed in orthopedics, cardiology and vascular surgery, continuously increases. While healthcare providers make efforts in improving patient care as well as outcomes en route to precisely and timely courtesy of C-arms, the adoption of C-arms becomes a requirement in this process. Reimbursement policies also form an integral parts of the operating US C-arms market trend. The need of healthcare facilities adjustment towards new reimbursement policy rates often occurs due to change in policy. Timely reimbursement to procedures using C-arms boost materialized exchange by medical practitioners thus causing increase in the number of manufacturers of the advanced imaging system. This further leads to the growth of C-arm market. Market competitiveness is one of the bedrocks of the US C-arms industry. It exerts tremendous impacts on the industry's functional patterns. Every single these manufacturers and these retailers fight for the share of the market; therefore , the innovation becomes the daily routine and the reasonable prices for all. Consequently, this is into the advantage of healthcare institutions, as they are provided with a multitude of models and therefore the market is expected to have an even more diversified geography. Not only the market factors but regulate ones also have a huge impact on the dynamics of the C-arms. Regulation and updating of compliance standards by the government bodies aims at assuring the safety and proper functioning medical devices. Manufacturers should then comply with the regulations, and it may be the case that the approval processing can influence the time it is, for instance, for the release of new C-arms. Purchasing for healthcare facilities includes economic elements like the total spending on health care and the need to adhere to the prescribed budget. C-arm component costs increase if other types of equipment continue to be manufactured and C-arm production is postponed or canceled as a result of economic downturns or reductions in the healthcare budget. However, periods of boom in an economy can be the source of financial resources that health institutions use to meet the required investment in sophisticated medical imaging technologies.

Lastly, the COVID-19 pandemic has had a notable impact on the US C-arms market. The increased focus on preparedness for infectious diseases and the need for versatile imaging solutions in emergency situations have led to a reassessment of the importance of C-arms in various healthcare settings.

Leave a Comment