Market Share

US C arms Market Share Analysis

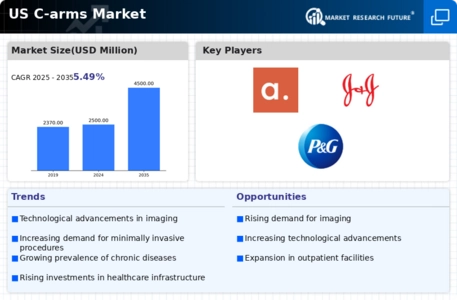

The U.S. C-arms market, a critical segment in the medical imaging industry, has witnessed dynamic shifts in market share positioning strategies. C-arms, essential for real-time imaging during surgical procedures, have seen intense competition among key players seeking to capture a larger market share. Companies operating in this space employ various strategies to differentiate themselves and gain a competitive edge. One culture segementation applies to growth of market shares is based on innovations and technological excellence of products. Companies sponsor R&D to be able to offer the latest C-Arm machines on the market with the added vantages of high image quality, advanced modes of imaging, and low exposure intensity. Advancements in medical technology are the driving power behind competition in this area. Companies are seeking to develop not only top-of-the line products but also tools that can improve patient outcomes and simplify the work for surgeons. Aside from strategic partnerships and collaborations, market share positioning is also enhanced by strategic partnerships and collaboration that is strategically implemented. Organizations align with healthcare facilities, providing services incentives, conducting surveys, or offering market-research data to lead their industries as well as influence their other stakeholders. More than providing a greater coverage, these partnerships also allow an exchange of knowledge and crafting of specialized processes that precisely address the requirements of the market. Creating and maintaining effective collaborative relationship enables the company to build upon other, than its own, strengths and collectively achieve the market growth. The c-arm market in the United States has four levels of segmentation that focus on price and value. Companies specialize in producing C-art products for various medical and fitness facilities based on the different application areas. Such approach allows companies to overcome multiple segments of healthcare effectively, within the scope of, so to say, orthopedics, cardiology and gastrointestinal procedures. By appropriately adjust their category range depending on the specific medical discipline requirements, the companies are able to give desired solutions to different segments, and consequently, maintain a competitive advantage.

Market expansion through geographical diversification is yet another strategy employed by companies in the U.S. C-arms market. By identifying and tapping into emerging markets, companies can broaden their customer base and reduce dependence on specific regions. This approach helps mitigate risks associated with economic fluctuations in any single market and ensures a more resilient and sustainable business model.

Leave a Comment