Emergence of Telehealth Services

The emergence of telehealth services is significantly impacting the US The Global Breast Cancer Industry by enhancing access to care for patients. Telehealth platforms enable remote consultations, follow-ups, and monitoring, which can be particularly beneficial for patients in rural or underserved areas. The COVID-19 pandemic accelerated the adoption of telehealth, and this trend appears to be continuing, with a reported 154% increase in telehealth visits in 2021. As patients increasingly seek convenient and accessible healthcare options, the US The Global Breast Cancer Industry is likely to adapt by integrating telehealth solutions into standard care practices, ultimately improving patient engagement and outcomes.

Government Initiatives and Funding

Government initiatives and funding play a crucial role in shaping the US The Global Breast Cancer Industry. The National Cancer Institute (NCI) allocates substantial resources to breast cancer research, with funding exceeding $600 million annually. These investments facilitate groundbreaking studies and clinical trials, ultimately leading to the development of new therapies and diagnostic tools. Additionally, public awareness campaigns, such as Breast Cancer Awareness Month, contribute to increased screening and early detection efforts. As a result, the US The Global Breast Cancer Industry benefits from enhanced research capabilities and improved patient outcomes, driven by government support and funding.

Growing Incidence of Breast Cancer

The US The Global Breast Cancer Industry is experiencing a notable increase in the incidence of breast cancer, which is projected to affect approximately 1 in 8 women during their lifetime. This rising prevalence is driving demand for innovative treatment options and early detection methods. According to the American Cancer Society, an estimated 287,850 new cases of invasive breast cancer are expected to be diagnosed in the United States in 2022 alone. This alarming statistic underscores the urgent need for advancements in research and development within the US The Global Breast Cancer Industry, as healthcare providers and pharmaceutical companies strive to address the growing patient population and improve outcomes.

Technological Advancements in Treatment

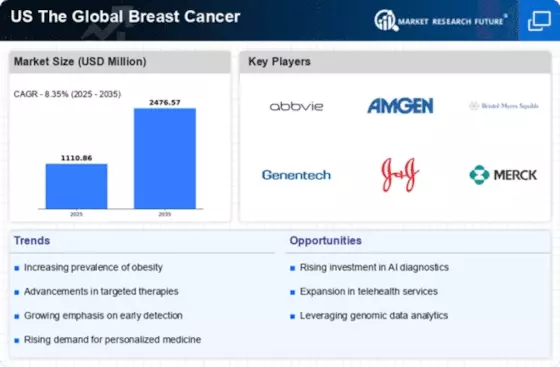

The US The Global Breast Cancer Industry is witnessing rapid technological advancements in treatment modalities, including targeted therapies and immunotherapies. These innovations are transforming the landscape of breast cancer treatment, offering patients more effective and personalized options. For instance, the introduction of CDK4/6 inhibitors has shown promising results in treating hormone receptor-positive breast cancer, leading to improved survival rates. The market for these therapies is expected to grow significantly, with projections indicating a compound annual growth rate (CAGR) of over 10% in the coming years. This trend highlights the importance of continued investment in research and development within the US The Global Breast Cancer Industry.

Rising Demand for Screening and Diagnostic Services

The US The Global Breast Cancer Industry is experiencing a surge in demand for screening and diagnostic services, driven by increased awareness and education about breast cancer. The implementation of guidelines recommending regular mammograms for women aged 40 and older has led to higher screening rates. According to the Centers for Disease Control and Prevention (CDC), approximately 72% of women aged 50-74 reported having a mammogram in the past two years. This growing emphasis on early detection is likely to propel the market for diagnostic imaging technologies and services, as healthcare providers seek to meet the needs of an increasingly health-conscious population within the US The Global Breast Cancer Industry.