Rising Prevalence of Hypertension

The increasing prevalence of hypertension in the US is a primary driver for the blood pressure-test market. According to the CDC, nearly 47 % of adults in the US have hypertension, which necessitates regular monitoring. This growing patient population creates a consistent demand for blood pressure testing devices and services. As healthcare providers emphasize the importance of early detection and management of hypertension, the blood pressure-test market is likely to experience significant growth. Furthermore, the aging population, which is more susceptible to hypertension, contributes to this trend. The need for effective monitoring solutions is paramount, as untreated hypertension can lead to severe health complications, thereby driving the market further.

Government Initiatives and Regulations

Government initiatives aimed at improving cardiovascular health significantly impact the blood pressure-test market. Programs promoting regular health screenings and awareness campaigns about hypertension are being implemented across various states. The US government has allocated substantial funding to support these initiatives, which encourages healthcare providers to adopt blood pressure testing as a routine practice. Additionally, regulatory bodies are establishing guidelines that mandate regular blood pressure monitoring in clinical settings. This regulatory environment fosters a conducive atmosphere for the growth of the blood pressure-test market, as compliance with these guidelines necessitates the procurement of testing devices and technologies.

Increased Focus on Preventive Healthcare

The increased focus on preventive healthcare is reshaping the blood pressure-test market. Healthcare providers are increasingly advocating for preventive measures to mitigate the risks associated with hypertension. This shift in focus encourages individuals to undergo regular blood pressure testing as part of routine health check-ups. The emphasis on preventive care is supported by various health organizations that promote awareness about the dangers of uncontrolled hypertension. As a result, the blood pressure-test market is likely to benefit from this trend, as more individuals seek out testing services to monitor their health proactively.

Growing Demand for Home Healthcare Solutions

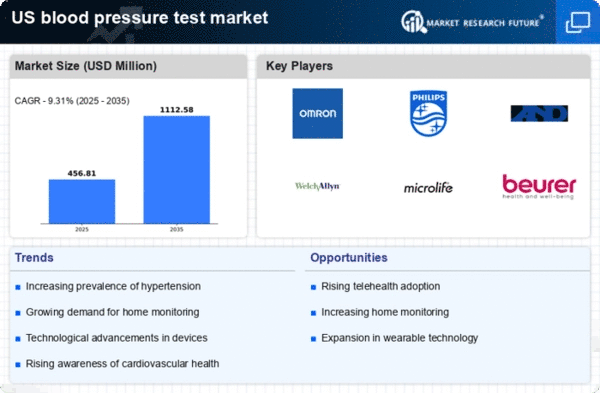

The growing demand for home healthcare solutions is a significant driver for the blood pressure-test market. As patients prefer to manage their health from the comfort of their homes, the need for at-home blood pressure monitoring devices has surged. The market for home healthcare products is expected to grow at a CAGR of 8 % from 2025 to 2030. This trend is particularly evident among older adults who require regular monitoring but may face mobility challenges. Consequently, manufacturers are focusing on developing user-friendly and accurate home testing devices, which is likely to enhance the market's growth prospects.

Innovations in Blood Pressure Monitoring Technology

Innovations in blood pressure monitoring technology are transforming the blood pressure-test market. The introduction of wearable devices and smartphone applications that allow for continuous monitoring is gaining traction among consumers. These advancements not only enhance user convenience but also improve data accuracy and accessibility. The market for digital health solutions is projected to reach $200 billion by 2025, indicating a robust growth trajectory. As consumers increasingly seek out these innovative solutions, healthcare providers are also adapting to incorporate these technologies into their practices. This trend suggests a shift towards more personalized and proactive healthcare, further propelling the blood pressure-test market.