Increasing Environmental Regulations

The biofiltration market is experiencing growth due to the increasing environmental regulations imposed by federal and state agencies in the US. These regulations aim to reduce pollution and improve air and water quality, thereby driving the demand for biofiltration systems. For instance, the Environmental Protection Agency (EPA) has established stringent guidelines for wastewater treatment, which necessitate the adoption of advanced filtration technologies. As a result, industries are compelled to invest in biofiltration solutions to comply with these regulations, leading to a projected market growth of approximately 8% annually over the next five years. This regulatory landscape is likely to create a favorable environment for the biofiltration market, as companies seek to enhance their sustainability practices and minimize their environmental footprint.

Rising Demand for Wastewater Treatment

The biofiltration market is significantly influenced by the rising demand for effective wastewater treatment solutions in the US. With urbanization and population growth, the volume of wastewater generated has increased, necessitating advanced treatment technologies. Biofiltration systems offer a cost-effective and efficient method for treating wastewater, which is becoming increasingly important for municipalities and industries alike. According to recent estimates, the US wastewater treatment market is expected to reach $50 billion by 2026, with biofiltration technologies playing a crucial role in this growth. This trend indicates a robust opportunity for the biofiltration market, as stakeholders seek innovative solutions to manage wastewater sustainably and efficiently.

Technological Innovations in Filtration

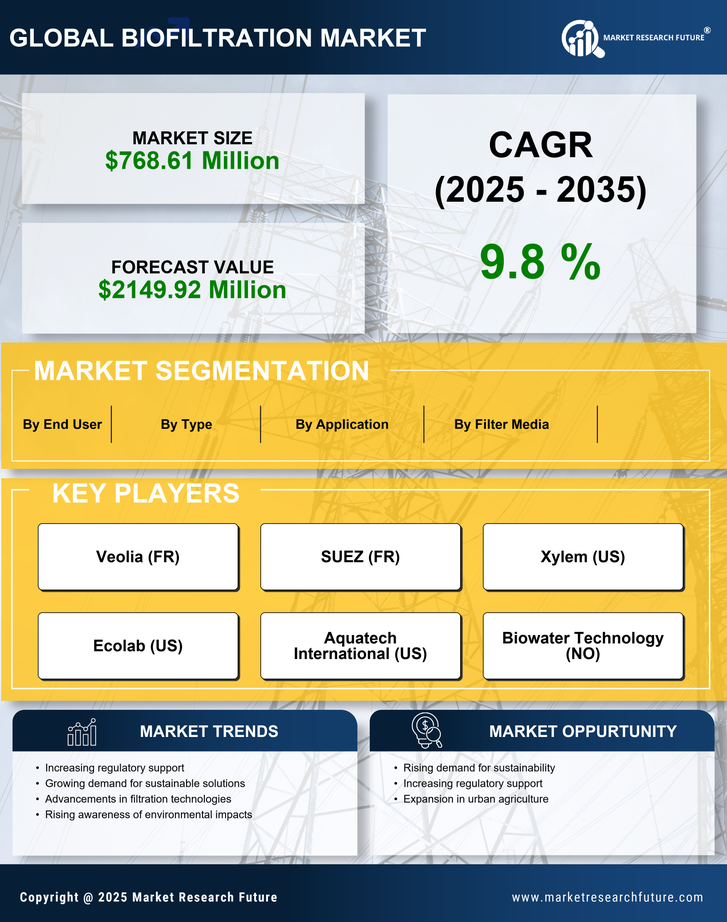

Technological innovations are driving the biofiltration market forward, as new advancements enhance the efficiency and effectiveness of biofiltration systems. Innovations such as the integration of artificial intelligence and machine learning in monitoring and controlling filtration processes are becoming more prevalent. These technologies allow for real-time data analysis and optimization of filtration performance, leading to improved outcomes in air and water treatment. The market for advanced filtration technologies is projected to grow at a CAGR of 7% through 2027, indicating a strong interest in biofiltration solutions. As industries increasingly adopt these innovations, the biofiltration market is likely to benefit from enhanced product offerings and increased market penetration.

Investment in Infrastructure Development

Investment in infrastructure development is a key driver for the biofiltration market, particularly in the context of water and wastewater management systems. The US government has recognized the need to upgrade aging infrastructure, leading to increased funding for water treatment facilities and related projects. The Infrastructure Investment and Jobs Act, for instance, allocates substantial resources for improving water quality and expanding treatment capabilities. This influx of investment is expected to create opportunities for biofiltration technologies, as municipalities and industries look to implement modern solutions to meet regulatory requirements and enhance service delivery. The biofiltration market stands to gain from this trend, as infrastructure projects increasingly incorporate advanced filtration systems.

Growing Awareness of Environmental Sustainability

The biofiltration market is benefiting from the growing awareness of environmental sustainability among consumers and businesses in the US. As public concern regarding climate change and environmental degradation rises, there is a notable shift towards sustainable practices across various sectors. Companies are increasingly adopting biofiltration systems as part of their corporate social responsibility initiatives, aiming to reduce their ecological impact. This trend is reflected in the increasing investments in green technologies, with the US green technology market projected to reach $1 trillion by 2030. The emphasis on sustainability is likely to propel the biofiltration market, as organizations seek to align their operations with environmentally friendly practices.