Surge in Sports Medicine

The bioceramics and-hydroxyapatite market is benefiting from the rising interest in sports medicine, which emphasizes injury prevention and recovery. As more individuals engage in sports and physical activities, the incidence of sports-related injuries is increasing, leading to a higher demand for effective treatment solutions. Bioceramics, particularly those incorporating hydroxyapatite, are being utilized in various applications, including joint repair and reconstruction. The sports medicine market is expected to grow significantly, potentially reaching $8 billion by 2026. This growth is likely to drive the adoption of bioceramics and hydroxyapatite materials, as they offer advantages such as enhanced healing and reduced recovery times for athletes.

Increased Research Funding

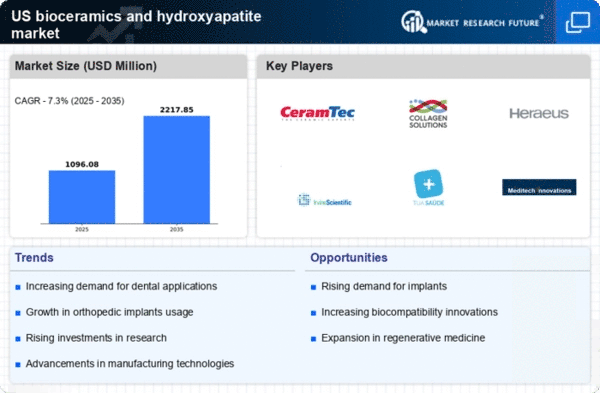

The bioceramics and-hydroxyapatite market is likely to benefit from increased research funding directed towards biomaterials and tissue engineering. Government and private sector investments in research initiatives are fostering innovation in the development of advanced bioceramics and hydroxyapatite products. Recent reports indicate that funding for biomaterials research has seen a substantial rise, with allocations exceeding $500 million annually in the US. This influx of funding is expected to accelerate the development of new applications and improve existing technologies within the bioceramics and-hydroxyapatite market. As researchers explore novel formulations and applications, the market is anticipated to expand, driven by enhanced product offerings and improved performance characteristics.

Growth in Regenerative Medicine

The bioceramics and-hydroxyapatite market is poised for growth due to the expanding field of regenerative medicine. This sector focuses on repairing or replacing damaged tissues and organs, and bioceramics are increasingly recognized for their potential in this area. The regenerative medicine market is projected to reach $100 billion by 2025, with bioceramics and hydroxyapatite materials being integral to tissue engineering and regenerative therapies. Their unique properties, such as bioactivity and compatibility with human tissues, make them suitable for applications in bone and cartilage regeneration. As research and development in regenerative medicine continue to advance, the bioceramics and-hydroxyapatite market is likely to see a corresponding increase in demand and application.

Innovations in Dental Applications

The bioceramics and-hydroxyapatite market is experiencing a surge in demand due to innovations in dental applications. Bioceramics are increasingly utilized in dental implants, root canal treatments, and bone grafting procedures. The dental implant market alone is anticipated to reach $10 billion by 2025, with bioceramics playing a crucial role in enhancing the longevity and success rates of these procedures. Hydroxyapatite, known for its osteoconductive properties, is particularly valued in dental applications for its ability to promote bone integration. As dental professionals continue to adopt advanced materials for improved patient care, the bioceramics and-hydroxyapatite market is likely to benefit from this trend, leading to increased market penetration and growth.

Rising Demand for Orthopedic Implants

The increasing prevalence of orthopedic disorders in the US is driving the demand for orthopedic implants, which significantly influences the bioceramics and-hydroxyapatite market. According to recent data, the orthopedic implant market is projected to reach approximately $45 billion by 2026, with a notable portion attributed to bioceramics and hydroxyapatite materials. These materials are favored for their biocompatibility and ability to promote bone regeneration. As the aging population grows, the need for effective solutions in joint replacement and fracture repair is expected to rise, further propelling the bioceramics and-hydroxyapatite market. The integration of advanced materials in implant technology is likely to enhance patient outcomes, thereby increasing the adoption of bioceramics and hydroxyapatite in orthopedic applications.