Government Incentives and Support

Government incentives play a crucial role in the bio based-succinic-acid market, fostering growth and innovation within the industry. Various federal and state programs are designed to support the development of bio-based chemicals, including grants, tax credits, and subsidies. These initiatives encourage companies to invest in sustainable production methods and technologies. For instance, the U.S. Department of Agriculture has implemented programs aimed at promoting bio-based products, which could potentially lead to a market expansion of over $1 billion by 2030. Such support not only enhances the competitiveness of bio based-succinic acid but also aligns with national goals for reducing greenhouse gas emissions and promoting renewable resources.

Innovations in Production Technologies

Innovations in production technologies are significantly impacting the bio based-succinic-acid market. Advances in fermentation processes and biocatalysis are enhancing the efficiency and cost-effectiveness of bio based-succinic acid production. These technological improvements are expected to reduce production costs by up to 20%, making bio based-succinic acid more competitive against traditional petrochemical alternatives. Additionally, the development of integrated biorefineries is likely to streamline production processes, further driving down costs. As these technologies mature, they may lead to increased adoption of bio based-succinic acid across various applications, thereby expanding the market's reach and potential. The industry appears poised for substantial growth as these innovations take hold.

Rising Demand for Eco-Friendly Products

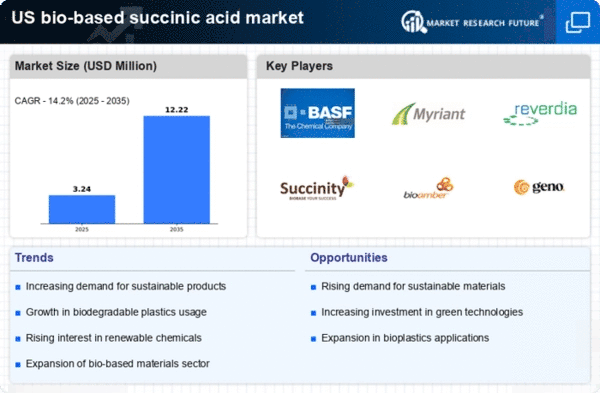

The bio based-succinic-acid market is experiencing a notable increase in demand for eco-friendly products. As consumers become more environmentally conscious, industries are shifting towards sustainable alternatives. This trend is particularly evident in sectors such as packaging, textiles, and automotive, where bio based-succinic acid serves as a renewable substitute for petroleum-based chemicals. The market is projected to grow at a CAGR of approximately 15% from 2025 to 2030, driven by this consumer preference. Companies are increasingly investing in bio based-succinic acid production to meet this demand, indicating a robust growth trajectory for the industry. Furthermore, regulatory frameworks promoting sustainable practices are likely to bolster this trend, enhancing the market's appeal to manufacturers seeking to align with eco-friendly initiatives.

Increased Awareness of Environmental Impact

Increased awareness of environmental impact is driving the bio based-succinic-acid market forward. As consumers and businesses alike become more informed about the ecological consequences of traditional chemical production, there is a growing shift towards sustainable alternatives. This heightened awareness is prompting manufacturers to seek out bio based-succinic acid as a viable option to reduce their carbon footprint. Reports suggest that companies utilizing bio-based materials can reduce greenhouse gas emissions by up to 50%. This trend is likely to continue influencing purchasing decisions and corporate strategies, thereby propelling the bio based-succinic-acid market towards greater adoption and integration into mainstream production processes.

Expanding Applications in Various Industries

The bio based-succinic-acid market is witnessing an expansion of applications across diverse industries, which is a key driver of growth. This versatile compound is increasingly utilized in the production of biodegradable plastics, solvents, and food additives, among others. The market for biodegradable plastics alone is projected to reach $6 billion by 2027, with bio based-succinic acid playing a pivotal role in this transition. Furthermore, its application in the pharmaceutical sector is gaining traction, as it is used in drug formulation and delivery systems. This diversification of applications not only enhances the market's resilience but also opens new avenues for growth, indicating a promising future for the bio based-succinic-acid market.