Advancements in Battery Technology

Technological innovations in battery chemistry and design are propelling the US Battery Energy Storage System Market forward. Recent advancements, such as the development of solid-state batteries and improvements in lithium-ion technology, have led to enhanced energy density, longer life cycles, and reduced costs. For instance, the cost of lithium-ion batteries has decreased by nearly 90% since 2010, making energy storage solutions more accessible to consumers and businesses alike. These advancements not only improve the performance of energy storage systems but also expand their applications across various sectors, including residential, commercial, and utility-scale projects. As technology continues to evolve, the US Battery Energy Storage System Market is poised for further growth, driven by the demand for efficient and cost-effective energy storage solutions.

Regulatory Support and Financial Incentives

The US Battery Energy Storage System Market benefits significantly from regulatory support and financial incentives provided by federal and state governments. Policies such as the Investment Tax Credit (ITC) and various state-level incentives encourage the adoption of energy storage technologies. In 2025, several states implemented new regulations aimed at promoting energy storage deployment, which is expected to drive market growth. These incentives not only lower the initial investment costs for consumers but also enhance the economic viability of energy storage projects. As regulatory frameworks continue to evolve, the US Battery Energy Storage System Market is likely to see increased participation from both private and public sectors, fostering a more robust energy storage ecosystem.

Growing Demand for Renewable Energy Integration

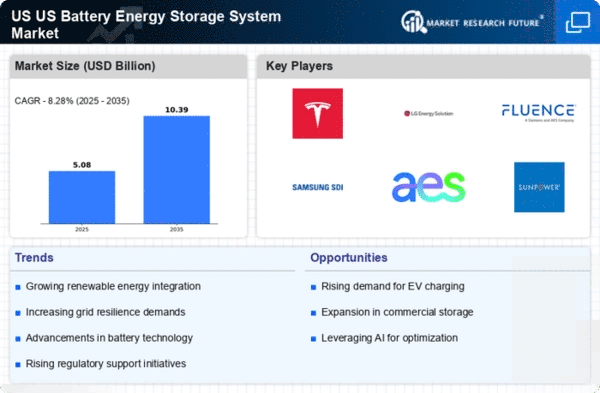

The US Battery Energy Storage System Market is experiencing a surge in demand driven by the increasing integration of renewable energy sources. As states and utilities aim to meet renewable portfolio standards, energy storage systems are becoming essential for balancing supply and demand. In 2025, the US installed capacity of battery storage reached approximately 30 gigawatts, reflecting a significant increase from previous years. This growth is largely attributed to the need for reliable energy storage solutions that can store excess energy generated from solar and wind sources. The ability of battery systems to provide grid stability and support renewable energy integration is likely to enhance their adoption in the coming years, positioning the US Battery Energy Storage System Market as a critical component of the energy transition.

Increased Investment in Energy Storage Projects

Investment in energy storage projects is on the rise, significantly impacting the US Battery Energy Storage System Market. In 2025, total investments in battery storage technologies reached approximately $10 billion, reflecting a growing recognition of the importance of energy storage in modern energy systems. This influx of capital is being directed towards both research and development of new technologies and the deployment of large-scale energy storage projects. Major utilities and private investors are increasingly funding battery storage initiatives, recognizing their potential to enhance grid reliability and support renewable energy integration. As investment continues to grow, the US Battery Energy Storage System Market is expected to benefit from enhanced technological advancements and increased deployment of energy storage solutions across various sectors.

Rising Electricity Prices and Demand for Energy Resilience

The US Battery Energy Storage System Market is also influenced by rising electricity prices and an increasing demand for energy resilience. As utility rates continue to climb, consumers and businesses are seeking ways to mitigate costs and ensure a reliable power supply. Energy storage systems provide a viable solution by allowing users to store energy during off-peak hours and utilize it during peak demand periods. This capability not only reduces electricity bills but also enhances energy independence. In 2025, the market for residential energy storage systems is projected to grow by over 30%, driven by the need for backup power solutions in the face of extreme weather events and grid instability. Consequently, the US Battery Energy Storage System Market is likely to expand as more consumers recognize the value of energy storage in achieving cost savings and resilience.