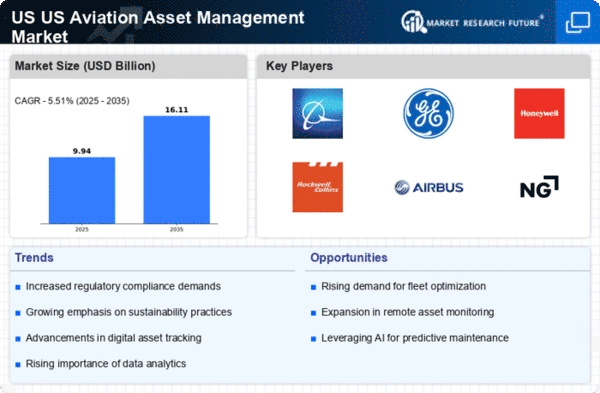

Growing Demand for Fleet Optimization

The US Aviation Asset Management Market is witnessing a growing demand for fleet optimization as airlines seek to enhance operational efficiency and reduce costs. With the increasing complexity of fleet operations, airlines are turning to sophisticated asset management solutions that provide insights into fleet performance, maintenance needs, and lifecycle management. According to industry reports, airlines that implement effective fleet optimization strategies can achieve cost savings of up to 15 percent. This trend is further fueled by the need to adapt to fluctuating market conditions and passenger demand. As airlines strive to maximize asset utilization and minimize downtime, the focus on fleet optimization is expected to drive growth in the US Aviation Asset Management Market, leading to the adoption of advanced analytics and management tools.

Regulatory Compliance and Safety Standards

The US Aviation Asset Management Market is significantly influenced by stringent regulatory compliance and safety standards imposed by the Federal Aviation Administration (FAA) and other governing bodies. These regulations necessitate rigorous asset management practices to ensure safety and reliability in aviation operations. Compliance with these standards often requires investment in advanced asset management systems that can track maintenance history, monitor asset conditions, and ensure adherence to safety protocols. The FAA's emphasis on safety management systems (SMS) has led to increased demand for comprehensive asset management solutions that can provide real-time data and analytics. Consequently, companies that prioritize regulatory compliance are likely to gain a competitive edge in the US Aviation Asset Management Market, as they can mitigate risks and enhance operational safety.

Increased Investment in Aviation Infrastructure

The US Aviation Asset Management Market is poised for growth due to increased investment in aviation infrastructure. Government initiatives and private sector investments are driving the modernization of airports and air traffic management systems. The Federal Aviation Administration (FAA) has allocated substantial funding for infrastructure improvements, which is expected to enhance operational efficiency and safety. This influx of capital is likely to create opportunities for asset management firms to provide innovative solutions that align with the evolving infrastructure landscape. As airports upgrade their facilities and technologies, the demand for effective asset management strategies will rise, enabling stakeholders to optimize their investments and improve service delivery. Consequently, the increased focus on aviation infrastructure is anticipated to be a key driver in the US Aviation Asset Management Market.

Sustainability and Environmental Considerations

The US Aviation Asset Management Market is increasingly influenced by sustainability and environmental considerations. As the aviation sector faces mounting pressure to reduce its carbon footprint, asset management practices are evolving to incorporate sustainable practices. Airlines are investing in fuel-efficient aircraft and exploring alternative fuels, which necessitates effective asset management to track performance and emissions. The implementation of sustainable asset management practices can lead to significant reductions in operational costs and environmental impact. For instance, the adoption of green technologies and practices in asset management can potentially reduce emissions by up to 50 percent. This shift towards sustainability is likely to shape the future of the US Aviation Asset Management Market, as stakeholders prioritize environmentally responsible practices.

Technological Advancements in Aviation Asset Management

The US Aviation Asset Management Market is experiencing a notable shift due to rapid technological advancements. Innovations such as artificial intelligence, machine learning, and big data analytics are enhancing asset tracking and management capabilities. These technologies enable airlines and asset managers to optimize maintenance schedules, reduce operational costs, and improve asset utilization. For instance, predictive maintenance powered by AI can lead to a reduction in unscheduled maintenance events by up to 30 percent, thereby increasing aircraft availability. Furthermore, the integration of blockchain technology is anticipated to enhance transparency and security in asset transactions, fostering trust among stakeholders. As these technologies continue to evolve, they are likely to reshape the operational landscape of the US Aviation Asset Management Market, driving efficiency and profitability.