Regulatory Support and Standards

Regulatory support and evolving standards play a crucial role in shaping the US Automotive Perimeter Lighting System Market. Government agencies are increasingly focusing on establishing guidelines that promote safety and efficiency in automotive lighting. For instance, the National Highway Traffic Safety Administration (NHTSA) has been proactive in developing regulations that encourage the adoption of advanced lighting technologies. These regulations not only aim to enhance road safety but also to reduce energy consumption in vehicles. As manufacturers align their products with these standards, the market is likely to witness a shift towards more compliant and innovative perimeter lighting solutions. This regulatory environment is expected to foster growth in the US Automotive Perimeter Lighting System Market, as companies strive to meet the demands of both consumers and regulatory bodies.

Consumer Demand for Customization

Consumer preferences are evolving, with a growing demand for customization in the US Automotive Perimeter Lighting System Market. Modern consumers are increasingly seeking personalized features that reflect their individual style and enhance their vehicle's aesthetics. This trend is evident in the rising popularity of customizable lighting options, such as color-changing LEDs and programmable lighting patterns. Manufacturers are responding by offering a wider range of perimeter lighting solutions that cater to these preferences. The ability to personalize lighting not only enhances the vehicle's appearance but also allows owners to express their identity. As this trend continues to gain traction, the US Automotive Perimeter Lighting System Market is expected to expand, driven by the desire for unique and tailored automotive experiences.

Focus on Safety and Security Features

Safety and security remain paramount concerns for consumers in the US Automotive Perimeter Lighting System Market. Enhanced perimeter lighting systems are increasingly viewed as essential for improving vehicle safety during nighttime operations. The presence of well-lit surroundings can deter criminal activities and enhance the visibility of pedestrians and cyclists. According to recent studies, vehicles equipped with advanced perimeter lighting systems report a reduction in nighttime accidents by up to 30%. This statistic underscores the importance of perimeter lighting in promoting road safety. As regulatory bodies continue to emphasize safety standards, manufacturers are likely to prioritize the development of innovative lighting solutions that meet these requirements, thereby driving growth in the US Automotive Perimeter Lighting System Market.

Integration with Smart Vehicle Technologies

The integration of smart vehicle technologies is a significant driver in the US Automotive Perimeter Lighting System Market. As vehicles become increasingly connected, the demand for perimeter lighting systems that can communicate with other smart features is on the rise. For instance, perimeter lights that sync with vehicle alarms or navigation systems can enhance user experience and safety. The market is witnessing a trend where perimeter lighting is not just a standalone feature but part of a broader ecosystem of smart technologies. This integration is expected to attract tech-savvy consumers who prioritize advanced functionalities in their vehicles. As a result, the US Automotive Perimeter Lighting System Market is likely to see a shift towards more interconnected and intelligent lighting solutions.

Technological Advancements in Lighting Solutions

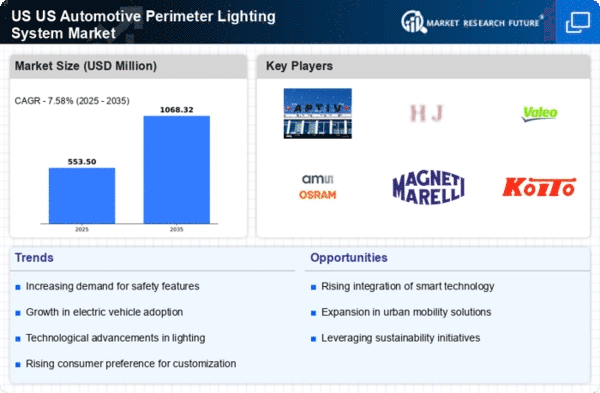

The US Automotive Perimeter Lighting System Market is experiencing a surge in technological advancements, particularly in LED and OLED lighting technologies. These innovations not only enhance visibility but also improve energy efficiency, which is becoming increasingly important to consumers. The market for automotive lighting is projected to grow significantly, with estimates suggesting a compound annual growth rate of around 5% through 2026. This growth is driven by the demand for more sophisticated lighting systems that offer better illumination and aesthetic appeal. Furthermore, the integration of adaptive lighting systems that adjust based on driving conditions is likely to become a standard feature, thereby enhancing the overall driving experience. As manufacturers invest in research and development, the US Automotive Perimeter Lighting System Market is poised for substantial transformation.