Regulatory Support and Safety Standards

The US Automotive Lane Warning System Market benefits significantly from regulatory support aimed at enhancing road safety. The National Highway Traffic Safety Administration (NHTSA) has established guidelines that encourage the adoption of lane warning systems in new vehicles. These regulations are designed to reduce accidents caused by driver inattention and lane drift. As of January 2026, the NHTSA has proposed that all new vehicles be equipped with some form of lane departure warning technology, which could potentially increase market penetration. This regulatory push not only fosters innovation among manufacturers but also instills consumer confidence in the safety features of modern vehicles, thereby driving demand for lane warning systems.

Increased Focus on Fleet Safety Management

The US Automotive Lane Warning System Market is also driven by an increased focus on fleet safety management. Companies operating fleets are recognizing the importance of equipping their vehicles with lane warning systems to minimize accidents and improve driver safety. Fleet operators are increasingly adopting these technologies as part of their safety protocols, which can lead to reduced insurance costs and liability. The market for fleet management solutions is projected to grow significantly, with lane warning systems being a key component. This trend reflects a broader commitment to safety and efficiency in commercial transportation, thereby bolstering the demand for lane warning technologies.

Consumer Demand for Enhanced Safety Features

The US Automotive Lane Warning System Market is significantly influenced by consumer demand for enhanced safety features in vehicles. As awareness of road safety issues grows, consumers are increasingly seeking vehicles equipped with advanced safety technologies, including lane warning systems. Surveys indicate that over 70% of potential car buyers prioritize safety features when making purchasing decisions. This trend is further supported by the increasing number of road accidents attributed to lane departure incidents. Consequently, automakers are responding by integrating lane warning systems into their vehicles, which not only meets consumer expectations but also aligns with market trends towards safer driving experiences.

Integration with Autonomous Driving Technologies

The US Automotive Lane Warning System Market is poised for growth due to the integration of lane warning systems with autonomous driving technologies. As the automotive industry moves towards fully autonomous vehicles, lane warning systems play a crucial role in ensuring safe navigation. These systems provide essential data to autonomous driving algorithms, enhancing their ability to maintain lane discipline. The market for autonomous vehicles is expected to reach USD 60 billion by 2030, and lane warning systems are integral to this evolution. This synergy between lane warning technologies and autonomous driving capabilities is likely to drive further investment and innovation in the market.

Technological Advancements in Lane Warning Systems

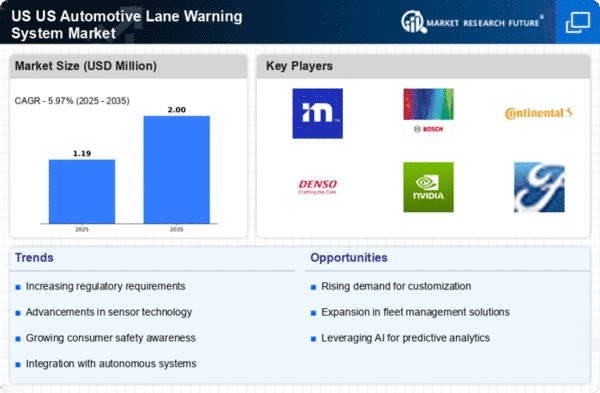

The US Automotive Lane Warning System Market is experiencing rapid technological advancements that enhance vehicle safety. Innovations such as lane departure warning (LDW) and lane keeping assist (LKA) systems are becoming increasingly sophisticated, utilizing sensors and cameras to monitor lane markings. According to recent data, the market for lane warning systems is projected to grow at a compound annual growth rate (CAGR) of approximately 10% through 2028. This growth is driven by the integration of artificial intelligence and machine learning, which improve the accuracy and responsiveness of these systems. As automakers invest in advanced driver-assistance systems (ADAS), the demand for lane warning technologies is expected to rise, reflecting a broader trend towards automation in the automotive sector.