Advancements in Reproductive Technologies

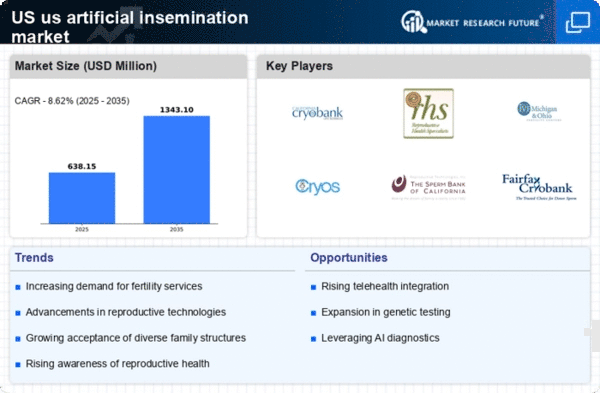

Technological innovations play a pivotal role in shaping the US Artificial Insemination Market. Recent advancements in reproductive technologies, such as in vitro fertilization and preimplantation genetic testing, have significantly improved success rates for artificial insemination procedures. The integration of artificial intelligence and machine learning in reproductive health is also emerging, potentially enhancing patient outcomes. As these technologies become more accessible, they are likely to attract a broader demographic seeking fertility solutions. The US market is projected to witness a compound annual growth rate of around 10 percent over the next five years, indicating a robust growth trajectory fueled by these advancements.

Government Support and Funding Initiatives

Government policies and funding initiatives are crucial drivers of the US Artificial Insemination Market. Various federal and state programs aim to support reproductive health services, including artificial insemination. For instance, the Affordable Care Act mandates coverage for certain fertility treatments, which has increased access for many individuals. Additionally, grants and funding from organizations such as the National Institutes of Health promote research and development in reproductive technologies. This governmental backing not only enhances the credibility of the market but also encourages healthcare providers to invest in advanced reproductive services, thereby fostering growth in the US Artificial Insemination Market.

Increasing Demand for Fertility Treatments

The US Artificial Insemination Market is experiencing a notable surge in demand for fertility treatments. Factors such as delayed childbearing, lifestyle changes, and rising infertility rates contribute to this trend. According to the Centers for Disease Control and Prevention, approximately 12 percent of women aged 15-44 face difficulties in conceiving, which has led to a growing acceptance of assisted reproductive technologies. This increasing demand is driving healthcare providers to expand their offerings, thereby enhancing the market landscape. Furthermore, the rising awareness of reproductive health issues among the population is likely to propel the growth of the US Artificial Insemination Market, as more individuals seek solutions to their fertility challenges.

Rising Awareness and Education on Reproductive Health

The growing awareness and education surrounding reproductive health significantly influence the US Artificial Insemination Market. Educational campaigns and resources provided by healthcare organizations are helping to demystify artificial insemination and other fertility treatments. As individuals become more informed about their reproductive options, they are more likely to seek assistance when facing fertility challenges. This trend is particularly evident among younger generations who prioritize family planning and reproductive health. Consequently, the increased awareness is expected to drive demand for artificial insemination services, further propelling the growth of the US Artificial Insemination Market.

Cultural Shifts and Acceptance of Alternative Family Structures

Cultural shifts in the United States are reshaping perceptions of family structures, which in turn impacts the US Artificial Insemination Market. There is a growing acceptance of diverse family formations, including single-parent households and same-sex couples seeking to start families. This evolving societal landscape has led to an increased demand for artificial insemination services as these groups often rely on assisted reproductive technologies to conceive. As societal norms continue to evolve, the market is likely to expand to accommodate the needs of these diverse family units, thereby driving growth in the US Artificial Insemination Market.