Innovative Research and Development

Ongoing research and development efforts in the arachnoiditis market are pivotal in shaping the future of treatment options. Pharmaceutical companies and research institutions are investing significantly in the exploration of novel therapies, including biologics and gene therapy. This investment is expected to yield innovative solutions that address the underlying causes of arachnoiditis, rather than merely managing symptoms. The US market has seen a surge in clinical trials, with over 30 active studies focusing on various treatment modalities. As these advancements materialize, they are likely to enhance patient outcomes and expand the market's therapeutic landscape.

Increasing Incidence of Arachnoiditis

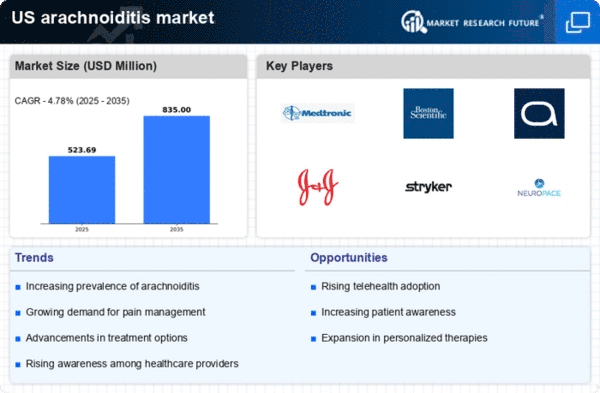

The arachnoiditis market is experiencing growth due to the rising incidence of arachnoiditis in the US. Factors such as an aging population and increased prevalence of spinal surgeries contribute to this trend. According to recent estimates, the incidence rate of arachnoiditis is approximately 1.5 to 2.5 cases per 100,000 individuals annually. This growing patient population necessitates enhanced treatment options and management strategies, thereby driving demand within the arachnoiditis market. Furthermore, as awareness of the condition increases among healthcare professionals and patients, the likelihood of diagnosis improves, potentially leading to higher treatment rates and market expansion.

Regulatory Support and Policy Changes

Regulatory support plays a crucial role in the arachnoiditis market, as favorable policies can expedite the approval of new treatments. The US Food and Drug Administration (FDA) has been increasingly proactive in facilitating the development of therapies for rare diseases, including arachnoiditis. Recent initiatives aim to streamline the approval process for innovative treatments, which could lead to a more robust market environment. Additionally, the potential for orphan drug designation may incentivize pharmaceutical companies to invest in the arachnoiditis market, further driving growth and improving patient access to necessary therapies.

Increased Focus on Patient-Centric Care

The shift towards patient-centric care is influencing the arachnoiditis market significantly. Healthcare providers are increasingly prioritizing patient preferences and experiences in treatment planning. This trend is reflected in the growing emphasis on shared decision-making and personalized treatment approaches. As patients become more engaged in their healthcare, there is a corresponding demand for therapies that align with their individual needs and lifestyles. This focus on patient-centric care is likely to drive innovation and competition within the arachnoiditis market, as companies strive to develop solutions that resonate with patients.

Growing Demand for Pain Management Solutions

The demand for effective pain management solutions is a significant driver in the arachnoiditis market. Patients suffering from chronic pain associated with arachnoiditis often seek comprehensive management strategies, which include pharmacological and non-pharmacological approaches. The market for pain management in the US is projected to reach $100 billion by 2026, indicating a substantial opportunity for growth within the arachnoiditis market. As healthcare providers increasingly recognize the importance of addressing pain comprehensively, the development of targeted therapies and multidisciplinary treatment plans is likely to gain traction.