Increasing Air Traffic Demand

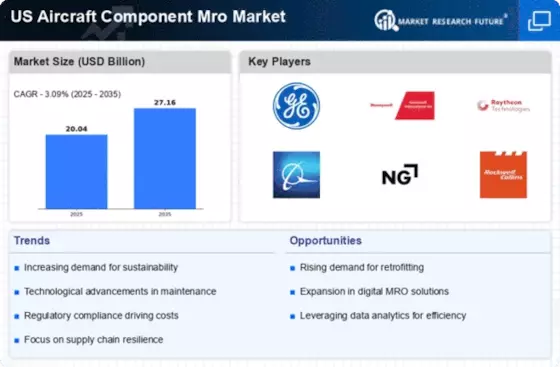

The US Aircraft Component MRO Market is experiencing a notable surge in demand due to increasing air traffic. According to the Federal Aviation Administration, air travel in the United States is projected to grow significantly, with passenger numbers expected to reach 1 billion by 2026. This growth necessitates a corresponding increase in maintenance, repair, and overhaul services for aircraft components. Airlines are compelled to ensure their fleets are operationally efficient and compliant with safety regulations, which drives demand for MRO services. As a result, the US Aircraft Component MRO Market is likely to expand, with companies investing in advanced technologies and skilled labor to meet the rising needs of the aviation sector.

Growing Focus on Sustainability

The US Aircraft Component MRO Market is increasingly aligning with sustainability initiatives as environmental concerns gain prominence. Airlines are under pressure to reduce their carbon footprint and enhance operational efficiency. This has led to a growing emphasis on sustainable practices within the MRO sector, such as the use of eco-friendly materials and processes. The adoption of sustainable practices not only helps in compliance with environmental regulations but also appeals to environmentally conscious consumers. Consequently, the US Aircraft Component MRO Market is likely to see a shift towards greener MRO solutions, which may enhance the reputation of service providers and attract new business.

Expansion of the Aviation Sector

The US Aircraft Component MRO Market is poised for growth due to the expansion of the aviation sector. With the increasing number of aircraft being manufactured and entering service, there is a corresponding rise in the demand for MRO services. The US is home to several major aircraft manufacturers, and as new models are introduced, the need for specialized MRO services becomes critical. This expansion is further supported by government initiatives aimed at bolstering the aviation industry, which may include funding for infrastructure improvements and workforce development. As a result, the US Aircraft Component MRO Market is likely to benefit from this growth trajectory, leading to increased investment and innovation.

Technological Advancements in MRO

The US Aircraft Component MRO Market is being transformed by rapid technological advancements. Innovations such as predictive maintenance, artificial intelligence, and data analytics are enhancing the efficiency and effectiveness of MRO services. For instance, predictive maintenance allows operators to anticipate component failures before they occur, thereby reducing downtime and maintenance costs. The integration of these technologies is expected to streamline operations and improve service delivery in the MRO sector. As airlines and MRO providers adopt these technologies, the US Aircraft Component MRO Market is likely to witness increased competitiveness and improved service offerings, ultimately benefiting the end-users.

Regulatory Compliance and Safety Standards

The US Aircraft Component MRO Market is heavily influenced by stringent regulatory compliance and safety standards imposed by the Federal Aviation Administration (FAA). These regulations mandate regular inspections and maintenance of aircraft components to ensure safety and reliability. As a result, MRO providers must adhere to these standards, which drives demand for their services. The FAA's focus on enhancing safety protocols and operational efficiency compels airlines to invest in MRO services, thereby propelling the growth of the US Aircraft Component MRO Market. Compliance with these regulations not only ensures passenger safety but also fosters trust in the aviation sector.