Rising Construction Activities

The US Acoustic Insulation Market is poised for growth due to the resurgence of construction activities across the nation. With the ongoing recovery in the housing market and increased investments in commercial infrastructure, the demand for acoustic insulation products is on the rise. According to the US Census Bureau, construction spending has shown a steady upward trend, with residential construction alone reaching over $900 billion in 2025. This surge in construction activities necessitates the incorporation of acoustic insulation to enhance soundproofing in new buildings. As architects and builders prioritize acoustic comfort in their designs, the market for acoustic insulation is likely to expand, driven by the need for effective sound management in various construction projects.

Increased Focus on Energy Efficiency

Energy efficiency is becoming a critical consideration in the US Acoustic Insulation Market. Acoustic insulation materials often provide thermal insulation benefits, which can lead to reduced energy consumption in buildings. The US government has implemented various energy efficiency programs and incentives, encouraging the adoption of insulation solutions that meet stringent energy standards. For instance, the Department of Energy's initiatives promote the use of high-performance insulation materials, which can enhance both acoustic and thermal performance. This dual benefit is likely to drive demand for acoustic insulation products, as builders and homeowners seek to comply with energy regulations while improving indoor comfort. The integration of energy-efficient acoustic insulation solutions is expected to play a significant role in shaping the market landscape.

Regulatory Standards and Building Codes

Regulatory standards and building codes play a pivotal role in shaping the US Acoustic Insulation Market. The implementation of stringent building codes aimed at improving sound insulation in residential and commercial buildings is driving the demand for acoustic insulation products. Local and state regulations often require specific acoustic performance levels, compelling builders and developers to incorporate effective insulation solutions. The International Building Code (IBC) and various state-specific codes outline requirements for sound transmission class (STC) ratings, influencing product selection in construction projects. As compliance with these regulations becomes increasingly important, the market for acoustic insulation is expected to grow, as stakeholders seek to meet or exceed these standards in their building designs.

Growing Demand for Noise Control Solutions

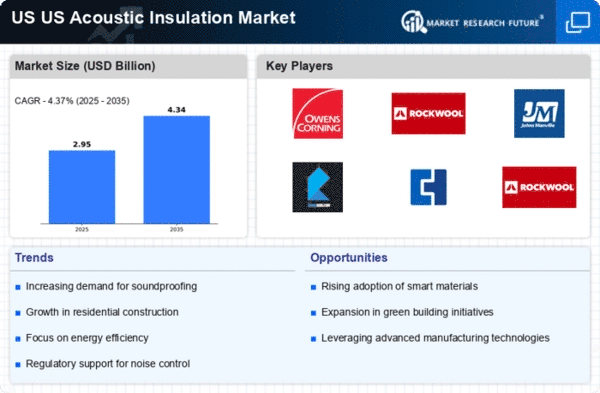

The US Acoustic Insulation Market is experiencing a notable increase in demand for effective noise control solutions. Urbanization and population growth have led to higher noise levels in residential and commercial areas, prompting consumers and businesses to seek acoustic insulation products. According to recent data, the market for acoustic insulation is projected to grow at a compound annual growth rate (CAGR) of approximately 5.2% through 2028. This growth is driven by the need for improved sound quality in various environments, including offices, schools, and healthcare facilities. As awareness of the negative impacts of noise pollution rises, the demand for acoustic insulation solutions is likely to continue to expand, positioning the US Acoustic Insulation Market for sustained growth.

Technological Advancements in Acoustic Materials

Technological advancements are significantly influencing the US Acoustic Insulation Market. Innovations in material science have led to the development of high-performance acoustic insulation products that offer superior sound absorption and noise reduction capabilities. Manufacturers are increasingly investing in research and development to create lightweight, eco-friendly materials that meet the evolving needs of consumers. For instance, the introduction of advanced composite materials and recycled content in insulation products is gaining traction. These innovations not only enhance acoustic performance but also align with sustainability goals, appealing to environmentally conscious consumers. As technology continues to evolve, the market is likely to witness the emergence of new products that further improve acoustic insulation performance.