Emergence of Smart Cities

The concept of smart cities is gaining traction, and this trend is a significant driver for the 6g market. As urban areas continue to expand, the need for efficient communication systems becomes critical. The 6g market is expected to facilitate the development of smart infrastructure, enabling real-time data exchange and improved urban management. Projections indicate that investments in smart city technologies could reach $1 trillion by 2025, underscoring the potential for 6g networks to support these initiatives. This integration of advanced communication technologies will likely enhance the quality of life for residents while driving economic growth in urban areas.

Increased Focus on Cybersecurity

As the 6g market evolves, the emphasis on cybersecurity is becoming increasingly pronounced. With the anticipated rise in data traffic and the integration of critical infrastructure, the need for robust security measures is paramount. The 6g market is expected to see significant investments in cybersecurity solutions to protect against potential threats. Analysts suggest that the cybersecurity market could grow to $300 billion by 2024, indicating a strong correlation between the growth of 6g technologies and the demand for enhanced security protocols. This focus on cybersecurity will likely shape the development of 6g networks, ensuring they are resilient against emerging threats.

Government Initiatives and Funding

Government initiatives play a pivotal role in shaping the 6g market. In the US, federal and state governments are increasingly recognizing the importance of advanced communication technologies. Funding programs aimed at research and development in 6g technologies are being established, with budgets potentially reaching billions of dollars. These initiatives are designed to foster innovation and ensure that the US remains competitive in the global telecommunications landscape. As a result, the 6g market is likely to benefit from enhanced collaboration between public and private sectors, driving technological advancements and market growth.

Rising Demand for IoT Applications

The proliferation of Internet of Things (IoT) devices is a critical driver for the 6g market. As more devices become interconnected, the need for higher bandwidth and lower latency becomes paramount. The 6g market is expected to support billions of devices, with estimates suggesting that the number of connected IoT devices could surpass 30 billion by 2030. This surge in demand necessitates the development of robust network infrastructures capable of handling vast amounts of data traffic. Consequently, telecommunications companies are likely to invest heavily in 6g technologies to meet these evolving requirements, thereby propelling the market forward.

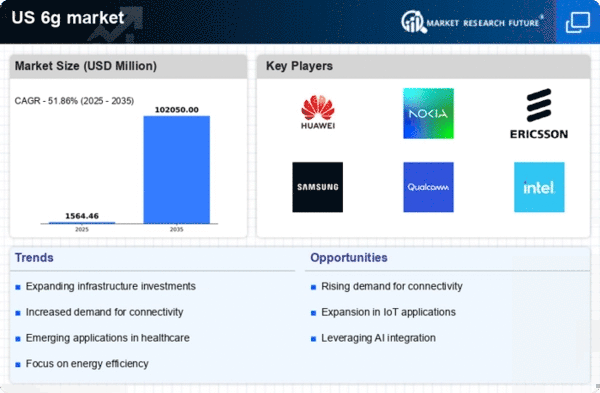

Advancements in Wireless Technology

The 6g market is poised for substantial growth due to rapid advancements in wireless technology. Innovations in antenna design, signal processing, and frequency utilization are expected to enhance data transmission rates significantly. For instance, the introduction of terahertz frequencies could potentially allow for data rates exceeding 1 Tbps, which is a remarkable leap from current 5g capabilities. This technological evolution is likely to attract investments, with projections indicating that the market could reach a valuation of $1 trillion by 2030. As companies strive to develop and implement these technologies, the 6g market will witness increased competition and collaboration among key players.