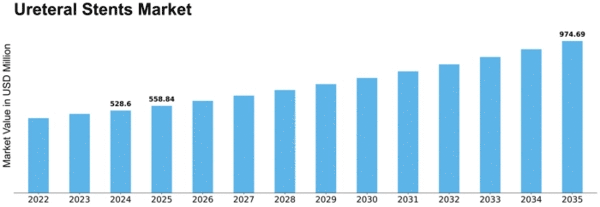

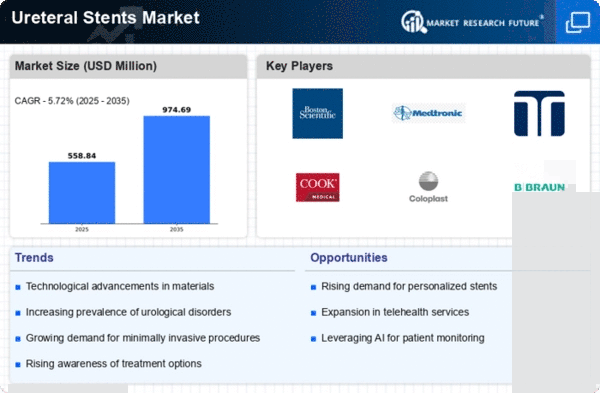

Ureteral Stents Size

Ureteral Stents Market Growth Projections and Opportunities

Ureteral Stents market is influenced by several key factors that collectively shape its dynamics and growth trajectory. One significant factor is the increasing prevalence of urological disorders and conditions, such as kidney stones and urinary obstructions, which drive the demand for ureteral stents. These small, flexible tubes play a critical role in maintaining patency of the ureter, relieving obstructions, and allowing urine to flow from kidneys into the bladder.

Besides, another thing that has contributed to a boom in Ureteral Stents market is an ageing population. As one ages, they are more prone to developing urological issues or complications that might require the use of ureteral stents. This demographic shift towards older age demography particularly in developed regions underscores the significance of urological interventions while driving up the demand for these medical devices.

Furthermore, there has been an upward trend on global kidney stone incidences as a major market driver. They facilitate easy passage of stones thereby providing relief as well as preventing possible complications. Timely intervention importance on cases of kidney stones has also led to increased adoption rates for ureteral stent use.

Additionally, hospital acquired infections are a challenge within healthcare sector also in Ureteral Stents market. The current trend is shifting towards development of antimicrobial coated stents addressing infection related complications due to prolonged placement of these devices within patients’ bodies. This goes hand in hand with broader healthcare focus on reducing HAIs incidence rates to enhance patient outcomes.

Moreover, there are rising number instances whereby outpatient procedures have become more common among various urological interventions affecting Ureteral Stents market. Some factors that have resulted into this include shorter hospital stays, faster recovery times and lower health costs associated with such procedures like placing ureteral stents. As such worldwide health systems continue emphasizing more about outpatient care; ureteral stent industry adjusts to fit these preferences.

Moreover, healthcare reforms and initiatives play a part in determining the Ureteral Stents market landscape. The growth of the market is enhanced by policies aimed at improving patient access to urological interventions and strengthening healthcare infrastructure. For instance, such schemes ensure that patients with urological disorders are treated on time by making sure they have access to ureter stenting facilities.

Also, Ureteral Stents market is affected by competition and key industry players. These have resulted into ongoing researches, development programs that are strategic, collaborations as well as mergers and acquisitions which affect the market dynamics in general. Competitive landscape drives innovation of products as well as new technologies introduction thus benefiting both healthcare providers and patients.

In addition, patient preferences and comfort are taken into account increasingly during the design of ureteral stents. Some of these innovations include coatings for the prevention of encrustation, smoother surfaces for reducing discomforts or user friendly designs leading to improved user experience. This enables acceptance as well compliance of patients with ureteral stent placement thereby enhancing quality life for those undergoing various urological interventions; hence growing this market.

Leave a Comment