Regulatory Support and Compliance

Regulatory support is a critical driver for the Upstream Bioprocessing Market, as stringent guidelines ensure the safety and efficacy of biopharmaceutical products. Regulatory bodies are increasingly providing frameworks that facilitate the approval of new bioprocessing technologies, which is essential for market players aiming to innovate. The harmonization of regulations across regions is also expected to simplify the compliance process, encouraging more companies to invest in upstream bioprocessing. As the industry evolves, adherence to these regulations will likely enhance consumer confidence and drive market expansion.

Rising Demand for Biopharmaceuticals

The Upstream Bioprocessing Market is experiencing a notable surge in demand for biopharmaceuticals, driven by the increasing prevalence of chronic diseases and the need for innovative therapies. As of 2025, the biopharmaceutical sector is projected to account for a substantial portion of the overall pharmaceutical market, with estimates suggesting it could reach over 300 billion USD. This growth is likely to propel investments in upstream bioprocessing technologies, as companies seek to enhance production efficiency and reduce costs. The focus on biologics, including monoclonal antibodies and vaccines, necessitates advanced upstream processes, thereby creating opportunities for market players to innovate and expand their offerings.

Growing Focus on Sustainable Practices

The Upstream Bioprocessing Market is increasingly influenced by a growing focus on sustainability. Companies are recognizing the importance of environmentally friendly practices in biomanufacturing, leading to the adoption of greener technologies and processes. This shift is likely to be driven by both regulatory pressures and consumer demand for sustainable products. As of 2025, it is projected that the market for sustainable bioprocessing solutions will grow significantly, with many companies investing in bioprocessing methods that minimize waste and energy consumption. This trend not only aligns with The Upstream Bioprocessing Market.

Technological Advancements in Bioprocessing

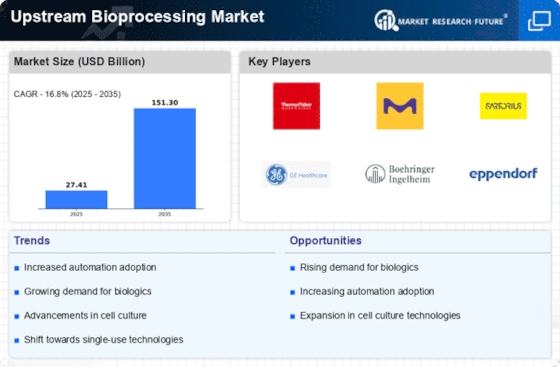

Technological advancements are playing a pivotal role in shaping the Upstream Bioprocessing Market. Innovations such as single-use bioreactors and automated cell culture systems are enhancing production capabilities and operational efficiency. The market for single-use technologies is expected to grow significantly, with projections indicating a compound annual growth rate of over 15% through 2025. These advancements not only streamline processes but also reduce contamination risks, making them increasingly attractive to biopharmaceutical manufacturers. As companies adopt these technologies, the overall productivity of upstream bioprocessing is likely to improve, further driving market growth.

Increased Investment in Research and Development

Investment in research and development is a significant driver for the Upstream Bioprocessing Market. Pharmaceutical companies are allocating substantial resources to R&D to discover new biologics and improve existing production processes. In 2025, it is anticipated that R&D spending in the biopharmaceutical sector will exceed 200 billion USD, reflecting a commitment to innovation. This influx of capital is likely to foster advancements in upstream bioprocessing technologies, enabling companies to enhance yield and reduce production times. Consequently, the focus on R&D is expected to propel the market forward.