Rising Energy Costs

The escalating costs of energy are a primary driver for the Micro Combined Heat and Power (MCHP Market) Market. As traditional energy prices continue to rise, consumers and businesses are increasingly seeking alternative solutions to mitigate their energy expenses. MCHP Market systems, which generate both heat and electricity from a single energy source, offer a compelling solution by enhancing energy efficiency and reducing reliance on grid electricity. According to recent data, the average residential electricity price has seen a steady increase, prompting a shift towards self-generation technologies. This trend is likely to bolster the adoption of MCHP Market systems, as they provide a cost-effective means of energy production, thereby appealing to both residential and commercial sectors.

Technological Innovations

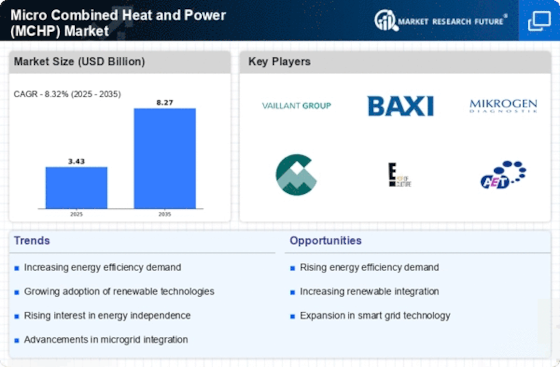

Technological innovations play a crucial role in shaping the Micro Combined Heat and Power (MCHP Market) Market. Advances in microgeneration technologies, such as improved fuel cells and more efficient heat recovery systems, are enhancing the performance and reliability of MCHP Market systems. These innovations not only increase energy efficiency but also reduce operational costs, making MCHP Market systems more appealing to potential users. For instance, recent developments in control systems and smart grid integration have enabled better management of energy production and consumption. As these technologies continue to evolve, they are likely to drive further adoption of MCHP Market systems across various sectors, including residential, commercial, and industrial applications.

Environmental Sustainability

The growing emphasis on environmental sustainability is significantly influencing the Micro Combined Heat and Power (MCHP Market) Market. With increasing awareness of climate change and the need for reduced carbon emissions, MCHP Market systems present an attractive option for environmentally conscious consumers. These systems utilize renewable energy sources, such as biomass or biogas, which can substantially lower greenhouse gas emissions compared to conventional energy sources. Furthermore, the integration of MCHP Market systems into energy strategies aligns with international commitments to reduce carbon footprints. As governments and organizations strive to meet sustainability targets, the demand for MCHP Market solutions is expected to rise, reflecting a broader commitment to environmental stewardship.

Government Incentives and Policies

Government incentives and policies are pivotal in propelling the Micro Combined Heat and Power (MCHP Market) Market. Many governments are implementing supportive measures, such as tax credits, rebates, and grants, to encourage the adoption of energy-efficient technologies. These initiatives aim to reduce energy consumption and promote the use of renewable energy sources. For example, certain regions have established feed-in tariffs for MCHP Market systems, ensuring a stable return on investment for users. Such policies not only enhance the economic viability of MCHP Market systems but also align with broader energy transition goals. As these supportive frameworks expand, they are expected to stimulate market growth and increase the penetration of MCHP Market technologies.

Increasing Demand for Energy Independence

The increasing demand for energy independence is a significant driver for the Micro Combined Heat and Power (MCHP Market) Market. As geopolitical tensions and energy supply disruptions become more prevalent, consumers and businesses are seeking ways to secure their energy sources. MCHP Market systems provide a viable solution by enabling users to generate their own electricity and heat on-site, thereby reducing dependence on external energy suppliers. This trend is particularly evident in regions with unstable energy markets, where self-sufficiency is becoming a priority. The potential for MCHP Market systems to enhance energy security is likely to drive their adoption, as users recognize the benefits of localized energy production.