Advancements in Automotive Technology

The Ultra Large Scale IC Market is significantly influenced by advancements in automotive technology, particularly with the rise of electric and autonomous vehicles. As the automotive sector increasingly integrates sophisticated electronic systems, the demand for ultra-large scale integrated circuits is expected to escalate. In 2025, the automotive electronics market is anticipated to exceed 300 billion USD, with a substantial share allocated to advanced driver-assistance systems (ADAS) and infotainment systems. These applications require high-performance ICs that can process large volumes of data in real-time. Furthermore, the transition towards electric vehicles necessitates efficient power management solutions, which are often realized through ultra-large scale ICs. This trend indicates a robust growth trajectory for the Ultra Large Scale IC Market, as automotive manufacturers seek to enhance vehicle performance and safety through advanced electronic components.

Rising Demand for Consumer Electronics

The Ultra Large Scale IC Market is experiencing a surge in demand driven by the increasing consumption of consumer electronics. As households and individuals seek advanced devices, the need for sophisticated integrated circuits becomes paramount. In 2025, the market for consumer electronics is projected to reach approximately 1 trillion USD, with a significant portion attributed to the adoption of ultra-large scale integrated circuits. This trend is likely to continue as innovations in smartphones, tablets, and smart home devices necessitate more complex and efficient ICs. The proliferation of 5G technology further amplifies this demand, as it requires high-performance chips capable of handling vast amounts of data. Consequently, manufacturers in the Ultra Large Scale IC Market are compelled to innovate and enhance their production capabilities to meet this growing consumer appetite.

Growth of Internet of Things (IoT) Applications

The proliferation of Internet of Things (IoT) applications is a key driver for the Ultra Large Scale IC Market. As more devices become interconnected, the demand for efficient and compact integrated circuits is on the rise. In 2025, the IoT market is projected to reach approximately 1.5 trillion USD, with a significant portion relying on ultra-large scale ICs for data processing and communication. These circuits enable seamless connectivity and functionality across various applications, including smart homes, industrial automation, and healthcare devices. The need for low-power, high-performance ICs is critical in these scenarios, as they must operate efficiently while managing extensive data flows. This trend suggests that the Ultra Large Scale IC Market will continue to expand, driven by the increasing integration of smart technologies into everyday life.

Emerging Applications in Artificial Intelligence

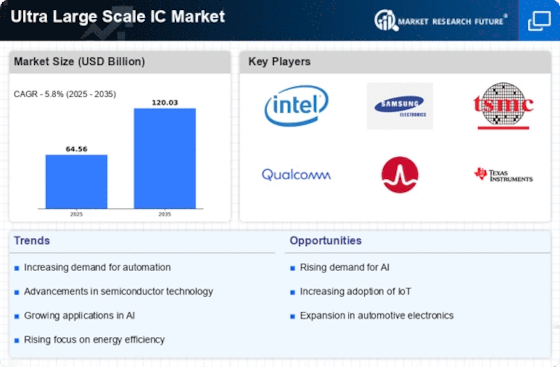

The integration of artificial intelligence (AI) into various sectors is emerging as a pivotal driver for the Ultra Large Scale IC Market. As AI technologies advance, the demand for high-performance computing capabilities increases, necessitating the use of ultra-large scale integrated circuits. In 2025, the AI market is expected to surpass 500 billion USD, with a considerable portion of this growth attributed to the need for advanced ICs that can support machine learning and data analytics. These applications require chips that can process vast amounts of information rapidly and efficiently. Consequently, manufacturers in the Ultra Large Scale IC Market are likely to focus on developing specialized ICs tailored for AI applications, thereby enhancing their competitive edge in a rapidly evolving technological landscape.

Increased Investment in Semiconductor Manufacturing

The Ultra Large Scale IC Market is poised for growth due to increased investment in semiconductor manufacturing. Governments and private entities are recognizing the strategic importance of semiconductor production, leading to substantial funding initiatives aimed at bolstering domestic manufacturing capabilities. In 2025, investments in semiconductor facilities are projected to exceed 100 billion USD, reflecting a commitment to enhancing production capacity and technological innovation. This influx of capital is likely to facilitate advancements in manufacturing processes, enabling the production of more complex and efficient ultra-large scale integrated circuits. As a result, the Ultra Large Scale IC Market stands to benefit from improved supply chain resilience and the ability to meet the escalating demand for advanced electronic components across various sectors.