Increased Focus on Safety and Performance

Safety and performance are paramount concerns for consumers in the UUHP Tire Market. As road conditions and driving environments become more challenging, the demand for tires that offer superior grip, stability, and durability is on the rise. Recent studies indicate that consumers are willing to invest more in high-quality tires that ensure their safety while driving. This trend is particularly evident in regions with extreme weather conditions, where the need for specialized tires is critical. The emphasis on performance is also reflected in the growing popularity of motorsports, which drives interest in high-performance tires. Consequently, manufacturers are increasingly focusing on developing tires that not only meet but exceed safety standards, thereby enhancing their appeal in the UUHP Tire Market.

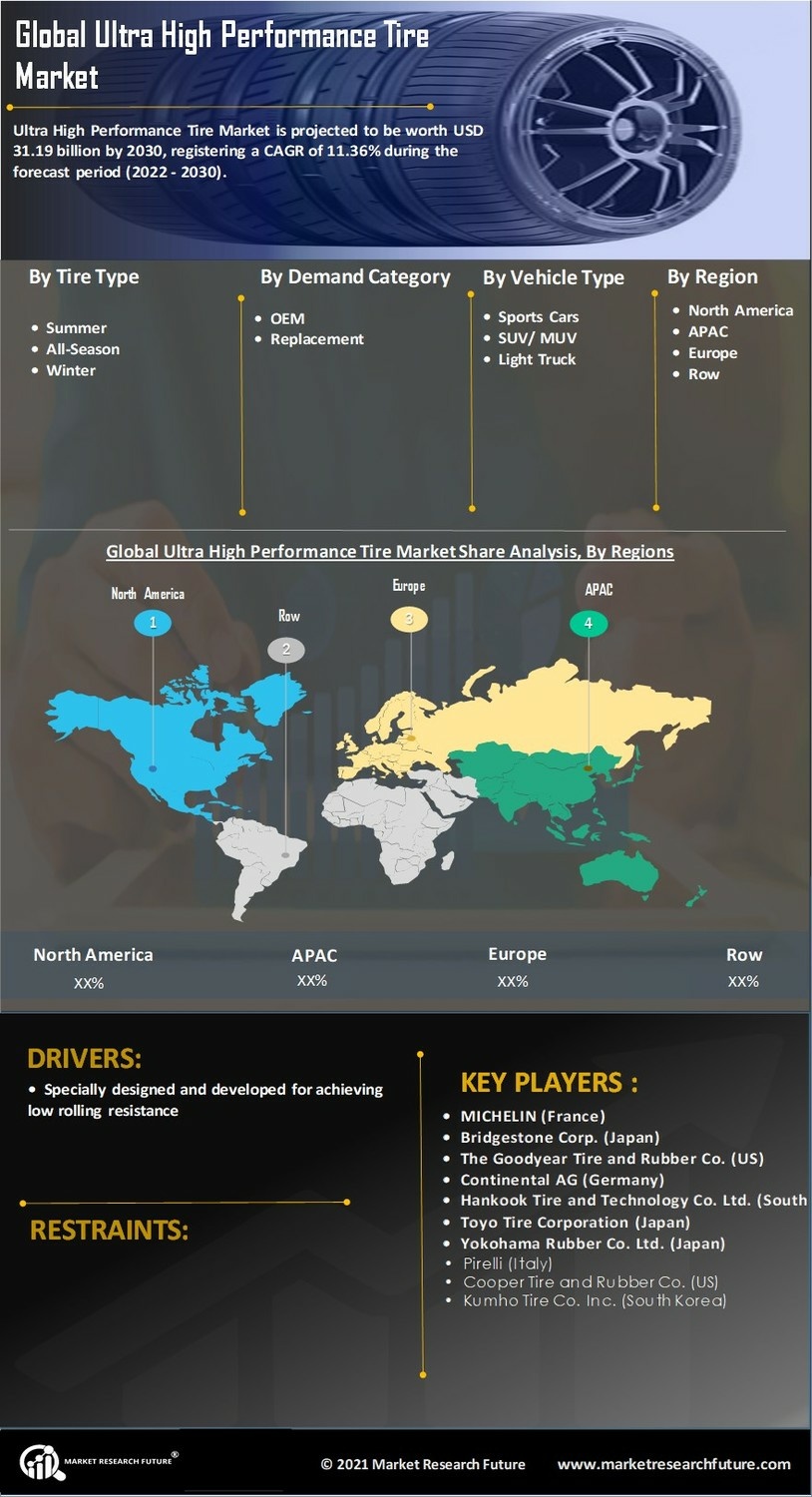

Rising Demand for High-Performance Vehicles

The increasing consumer preference for high-performance vehicles is a notable driver in the UUHP Tire Market. As automotive manufacturers focus on producing vehicles that offer superior speed, handling, and overall performance, the demand for ultra high-performance tires has surged. According to recent data, the segment of high-performance vehicles is projected to grow at a compound annual growth rate of approximately 6% over the next five years. This growth is likely to stimulate the UUHP Tire Market, as consumers seek tires that can enhance their driving experience. Furthermore, the trend towards electric and hybrid vehicles, which often require specialized tires, adds another layer of complexity to this demand. As such, manufacturers are compelled to innovate and develop tires that meet the specific needs of these high-performance vehicles.

Expansion of E-commerce and Online Retailing

The expansion of e-commerce and online retailing is reshaping the purchasing landscape in the UUHP Tire Market. Consumers are increasingly turning to online platforms to purchase tires, attracted by the convenience and often competitive pricing. Data suggests that online tire sales have seen a significant uptick, with estimates indicating a growth rate of over 10% in the next few years. This shift is prompting traditional retailers to adapt their strategies, often integrating online sales channels to remain competitive. Additionally, the availability of detailed product information and customer reviews online empowers consumers to make informed decisions, further driving the demand for ultra high-performance tires. As e-commerce continues to evolve, it is likely to play a crucial role in shaping the future dynamics of the UUHP Tire Market.

Regulatory Standards and Environmental Concerns

Regulatory standards and environmental concerns are increasingly influencing the UUHP Tire Market. Governments worldwide are implementing stricter regulations regarding tire performance, safety, and environmental impact. These regulations often require manufacturers to innovate and produce tires that not only meet performance criteria but also adhere to environmental standards. For instance, the push for reduced rolling resistance in tires is aimed at improving fuel efficiency and lowering carbon emissions. This regulatory landscape is expected to drive the development of eco-friendly tire options, which could account for a significant portion of the market in the coming years. As consumers become more environmentally conscious, the demand for sustainable tire solutions is likely to grow, thereby impacting the strategies of manufacturers within the UUHP Tire Market.

Technological Innovations in Tire Manufacturing

Technological advancements in tire manufacturing are significantly influencing the UUHP Tire Market. Innovations such as advanced materials, improved tread designs, and smart tire technology are enhancing tire performance and safety. For instance, the integration of sensors in tires allows for real-time monitoring of tire pressure and temperature, which can prevent accidents and improve fuel efficiency. The market for smart tires is expected to expand, with estimates suggesting a growth rate of around 8% annually. Additionally, the development of eco-friendly tire materials is becoming increasingly important, as consumers and manufacturers alike prioritize sustainability. These technological innovations not only improve the performance of ultra high-performance tires but also align with the evolving expectations of consumers, thereby driving growth in the UUHP Tire Market.