Rising Adoption of Cloud-Based Solutions

the tag management-software market witnesses a significant shift towards cloud-based solutions. As organisations in the UK increasingly migrate their operations to the cloud, the demand for cloud-compatible tag management systems is on the rise. This transition offers numerous advantages, including scalability, cost-effectiveness, and enhanced collaboration. According to industry reports, the cloud computing market in the UK is expected to grow by over 30% in the next few years. This trend is likely to influence the tag management-software market, as businesses seek solutions that integrate seamlessly with their cloud infrastructure. The flexibility and accessibility of cloud-based tag management software are expected to drive its adoption, enabling organisations to manage their data more efficiently and effectively.

Emergence of Advanced Marketing Technologies

the tag management-software market is shaped by the emergence of advanced marketing technologies. Innovations such as artificial intelligence (AI) and machine learning (ML) are transforming how businesses approach data management and analytics. In the UK, companies are increasingly adopting these technologies to enhance their marketing strategies and improve customer targeting. The integration of AI and ML into tag management solutions allows for more sophisticated data analysis and predictive modelling. This trend is indicative of a broader shift towards data-driven decision-making in marketing. As organisations seek to leverage these advanced technologies, the tag management-software market is likely to experience substantial growth, driven by the demand for innovative solutions that enhance marketing effectiveness.

Growing Demand for Real-Time Data Management

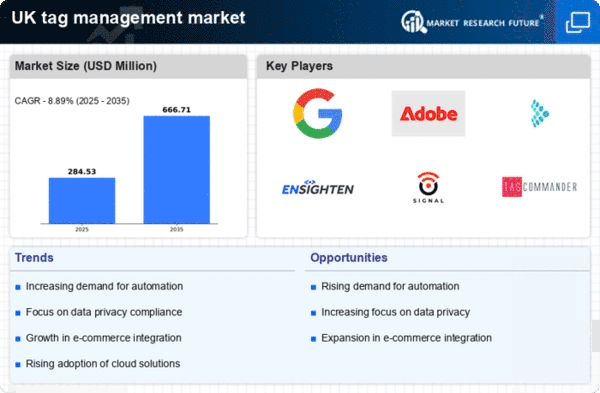

The tag management-software market is experiencing a notable surge in demand for real-time data management solutions. Businesses in the UK are increasingly recognising the necessity of immediate access to data for decision-making processes. This trend is driven by the need for agility in marketing strategies and customer engagement. According to recent estimates, the market for real-time analytics is projected to grow at a CAGR of approximately 25% over the next five years. As organisations strive to enhance their digital marketing efforts, the integration of tag management software becomes essential for optimising data collection and analysis. This growing demand for real-time capabilities is likely to propel the tag management-software market forward, as companies seek to leverage data for competitive advantage.

Increased Regulatory Compliance Requirements

The tag management-software market is significantly influenced by the rising regulatory compliance requirements in the UK. With the implementation of stringent data protection laws, such as the General Data Protection Regulation (GDPR), businesses are compelled to adopt robust tag management solutions to ensure compliance. These regulations necessitate transparent data handling practices, which can be effectively managed through advanced tag management systems. As organisations face potential fines of up to €20 million or 4% of their global turnover for non-compliance, the urgency to implement compliant solutions is paramount. This regulatory landscape is likely to drive growth in the tag management-software market, as companies invest in technologies that facilitate adherence to legal standards while maintaining effective data strategies.

Expansion of E-commerce and Digital Marketing

the tag management-software market benefits from the rapid expansion of e-commerce and digital marketing in the UK. As more businesses transition to online platforms, the need for effective data tracking and management becomes increasingly critical. The UK e-commerce market is projected to reach £200 billion by 2025, indicating a robust growth trajectory. This expansion necessitates sophisticated tag management solutions that can handle the complexities of online consumer behaviour and marketing campaigns. Companies are leveraging tag management software to streamline their data collection processes, enhance user experience, and optimise marketing efforts. Consequently, the growth of e-commerce is likely to serve as a catalyst for the tag management-software market, driving innovation and adoption of advanced solutions.