Increased Focus on Scalability

Scalability remains a critical driver in the serverless architecture market, particularly for UK businesses experiencing fluctuating workloads. The ability to automatically scale resources up or down based on demand is a significant advantage of serverless solutions. This flexibility allows companies to handle varying traffic loads without the need for extensive infrastructure management. Recent data indicates that organisations leveraging serverless architecture can achieve up to 50% faster deployment times, which is crucial in today’s fast-paced digital environment. As businesses strive to enhance their operational efficiency and customer satisfaction, the demand for scalable serverless solutions is expected to grow, further propelling the serverless architecture market.

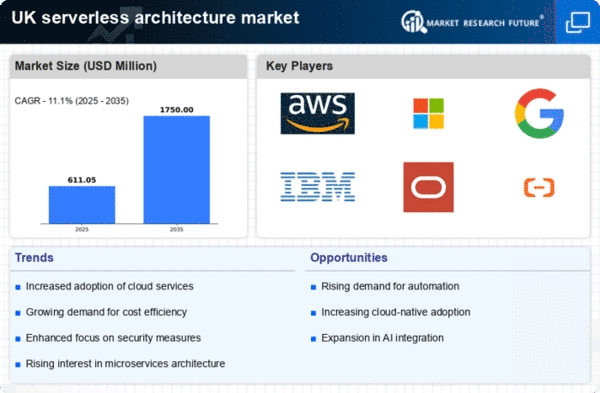

Growing Demand for Cost Efficiency

The serverless architecture market is experiencing a notable surge in demand for cost efficiency among businesses in the UK. Companies are increasingly seeking ways to reduce operational costs while maintaining high performance. Serverless architecture allows organisations to pay only for the compute resources they use, which can lead to substantial savings. According to recent estimates, businesses can save up to 30% on infrastructure costs by adopting serverless solutions. This financial incentive is driving many UK enterprises to transition from traditional server models to serverless architectures, thereby enhancing their agility and responsiveness to market changes. As the need for cost-effective solutions continues to rise, the serverless architecture market is likely to expand further, attracting more investments and innovations in the sector.

Shift Towards Microservices Architecture

The transition towards microservices architecture is significantly influencing the serverless architecture market in the UK. As organisations aim to improve their software development processes, microservices enable teams to build, deploy, and scale applications independently. This modular approach aligns well with serverless computing, which allows developers to focus on writing code without worrying about the underlying infrastructure. The serverless architecture market is likely to benefit from this trend, as more companies adopt microservices to enhance their agility and speed to market. It is estimated that by 2026, the adoption of microservices in the UK could lead to a 40% increase in the utilisation of serverless solutions, highlighting the interconnectedness of these two paradigms.

Emphasis on Enhanced Developer Experience

The serverless architecture market is increasingly shaped by the emphasis on enhancing the developer experience. As organisations in the UK strive to attract and retain top talent, providing a seamless and efficient development environment has become paramount. Serverless architecture simplifies the development process by abstracting infrastructure management, allowing developers to focus on writing code and delivering value. This shift is reflected in the growing popularity of serverless platforms, which offer robust tools and frameworks that streamline workflows. It is projected that by 2027, the serverless architecture market will see a 25% increase in adoption rates, driven by the desire for improved developer satisfaction and productivity. This focus on the developer experience is likely to continue influencing the market dynamics in the coming years.

Rising Need for Rapid Application Development

is being propelled by the increasing need for rapid application development among UK businesses.. In a landscape where time-to-market is critical, serverless solutions offer developers the ability to quickly build and deploy applications without the complexities of server management. This rapid development capability is particularly appealing to startups and enterprises looking to innovate swiftly. Recent surveys indicate that 70% of developers in the UK prefer serverless architecture for new projects due to its efficiency and speed. As the demand for faster application delivery continues to grow, the serverless architecture market is poised for significant expansion, attracting a diverse range of industries seeking to enhance their development processes.