Advancements in Synthetic Biology

Advancements in synthetic biology are significantly influencing the protein engineering market. The UK has emerged as a hub for synthetic biology research, with government initiatives supporting innovation in this field. The market for synthetic biology is anticipated to grow at a CAGR of 25% over the next five years, driven by the need for sustainable solutions in various industries. This growth is likely to enhance the capabilities of protein engineering, enabling the design of novel proteins with tailored functionalities. As synthetic biology techniques become more refined, the potential for creating high-value proteins for pharmaceuticals, agriculture, and industrial applications expands, thereby stimulating the protein engineering market. The integration of synthetic biology into protein engineering practices may lead to breakthroughs in product development and efficiency.

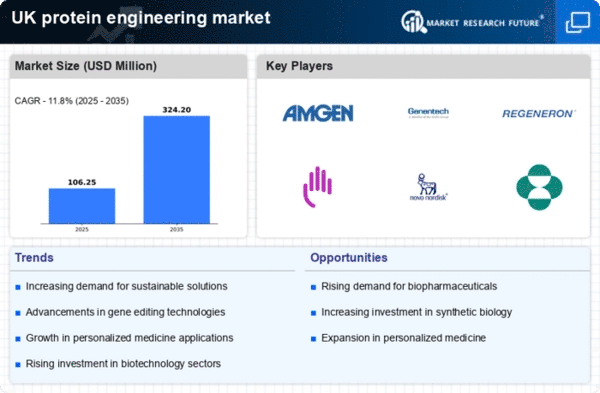

Rising Demand for Biopharmaceuticals

The increasing demand for biopharmaceuticals is a key driver in the protein engineering market. As the UK population ages, there is a growing need for innovative therapies that can address chronic diseases and genetic disorders. The biopharmaceutical sector is projected to reach £30 billion by 2025, indicating a robust growth trajectory. This surge in demand necessitates advanced protein engineering techniques to develop more effective and targeted treatments. Consequently, companies are investing heavily in research and development to enhance protein production processes, which is likely to propel the protein engineering market forward. The focus on biopharmaceuticals is expected to create numerous opportunities for protein engineers, as they play a crucial role in designing and optimizing therapeutic proteins.

Increased Investment in Biotechnology

The protein engineering market is experiencing a surge in investment within the biotechnology sector. In the UK, venture capital funding for biotech companies reached £2 billion in 2025, reflecting a strong interest in innovative solutions. This influx of capital is likely to accelerate research and development efforts in protein engineering, as companies seek to create novel therapeutic proteins and enzymes. The financial backing enables firms to explore cutting-edge technologies, such as CRISPR and directed evolution, which are essential for advancing protein engineering capabilities. As investment continues to flow into biotechnology, the protein engineering market is expected to benefit from enhanced resources and talent, fostering an environment conducive to innovation and growth.

Growing Focus on Sustainable Practices

The growing focus on sustainable practices is reshaping the protein engineering market. As environmental concerns rise, there is an increasing demand for sustainable protein production methods that minimize waste and reduce carbon footprints. The UK is actively promoting sustainability in biotechnology, with initiatives aimed at developing eco-friendly processes for protein engineering. This shift is likely to drive innovation in the market, as companies explore alternative sources of proteins, such as plant-based and microbial systems. The integration of sustainability into protein engineering practices not only addresses environmental challenges but also aligns with consumer preferences for ethically produced products. As a result, the protein engineering market may witness a transformation towards more sustainable and responsible practices.

Regulatory Support for Biotech Innovations

Regulatory support for biotechnology innovations is a crucial driver for the protein engineering market. The UK government has implemented policies aimed at fostering a conducive environment for biotech research and development. Initiatives such as the UK Biotech Strategy aim to streamline regulatory processes, making it easier for companies to bring new protein-based therapies to market. This supportive regulatory framework is likely to encourage investment and innovation in the protein engineering market, as firms can navigate the approval process more efficiently. Furthermore, the emphasis on safety and efficacy in regulatory guidelines ensures that advancements in protein engineering align with public health objectives, thereby enhancing the credibility and acceptance of new products.