Expansion of Offshore Wind Farms

The UK is witnessing a substantial expansion in offshore wind farm projects, which could serve as a crucial driver for the pipe laying-vessel market. With the government aiming for 40 GW of offshore wind capacity by 2030, the need for specialized vessels to lay underwater pipelines for these projects is likely to increase. This expansion not only supports the transition to renewable energy but also necessitates advanced pipe laying technologies. The pipe laying-vessel market may benefit from this trend, as companies seek to invest in vessels that can efficiently handle the unique challenges posed by offshore installations. The projected investment in offshore wind is estimated to reach £20 billion, further solidifying the market's potential.

Increasing Infrastructure Investment

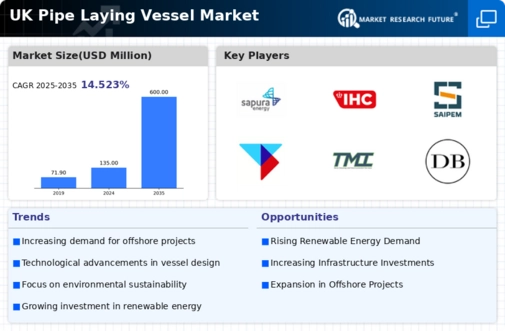

The UK government has been actively investing in infrastructure projects, which appears to be a significant driver for the pipe laying-vessel market. With a commitment of over £600 billion towards infrastructure development, including energy and transportation sectors, the demand for efficient pipe laying solutions is likely to rise. This investment is expected to enhance the capabilities of the pipe laying-vessel market, as modern vessels are essential for executing large-scale projects. Furthermore, the focus on upgrading existing pipelines and constructing new ones to support energy transition initiatives may further stimulate market growth. The integration of advanced technologies in these vessels could also lead to improved operational efficiency, thereby attracting more investments in the sector.

Environmental Regulations and Compliance

The implementation of stringent environmental regulations in the UK is likely to influence the pipe laying-vessel market significantly. As the government enforces stricter compliance measures for pipeline installations, companies may need to invest in advanced vessels that meet these regulations. This shift could lead to an increased demand for eco-friendly technologies within the pipe laying-vessel market. The focus on reducing carbon emissions and minimizing ecological impact may drive innovation in vessel design and operation. Companies that adapt to these regulations may find themselves at a competitive advantage, potentially leading to a more sustainable market landscape.

Rising Demand for Natural Gas Infrastructure

The increasing demand for natural gas in the UK is likely to act as a significant driver for the pipe laying-vessel market. As the country seeks to diversify its energy sources and reduce reliance on coal, the expansion of natural gas infrastructure becomes essential. This shift may necessitate the construction of new pipelines and the upgrading of existing ones, thereby increasing the demand for specialized vessels capable of laying these pipes. The projected growth in natural gas consumption is expected to reach 30% by 2030, which could further stimulate investments in the pipe laying-vessel market. Companies that can provide efficient and reliable solutions for natural gas pipeline installations may find lucrative opportunities in this evolving landscape.

Technological Integration in Vessel Operations

The integration of cutting-edge technologies in vessel operations is emerging as a pivotal driver for the pipe laying-vessel market. Innovations such as automation, real-time monitoring, and advanced navigation systems are likely to enhance operational efficiency and safety. As the industry moves towards digitalization, companies may invest in vessels equipped with these technologies to remain competitive. The potential for reduced operational costs and improved project timelines could make technologically advanced vessels more attractive to operators. This trend may also lead to a shift in market dynamics, as companies that embrace these innovations could capture a larger share of the pipe laying-vessel market.