Growing Geriatric Population

The demographic shift towards an aging population in the UK is a significant driver for the peripheral nerve-stimulators market. As individuals age, they are more susceptible to chronic pain conditions and neurological disorders, which increases the demand for effective pain management solutions. The Office for National Statistics reports that by 2030, the number of people aged 65 and over in the UK is projected to reach 18 million, representing a substantial market opportunity. This demographic trend suggests that healthcare systems will increasingly rely on peripheral nerve stimulators to address the unique needs of older patients, thereby fostering market growth. The focus on improving the quality of life for the elderly population is likely to further stimulate interest in these innovative devices.

Rising Incidence of Neurological Disorders

The increasing prevalence of neurological disorders in the UK is a primary driver for the peripheral nerve-stimulators market. Conditions such as neuropathic pain, multiple sclerosis, and Parkinson's disease are becoming more common, leading to a heightened demand for effective treatment options. According to recent health statistics, approximately 1 in 6 individuals in the UK are affected by neurological conditions, which translates to millions of potential patients. This growing patient population necessitates innovative solutions, such as peripheral nerve stimulators, to manage pain and improve quality of life. As healthcare providers seek to address these challenges, the peripheral nerve-stimulators market is likely to experience substantial growth, driven by the need for advanced therapeutic devices that can alleviate symptoms and enhance patient outcomes.

Technological Innovations in Medical Devices

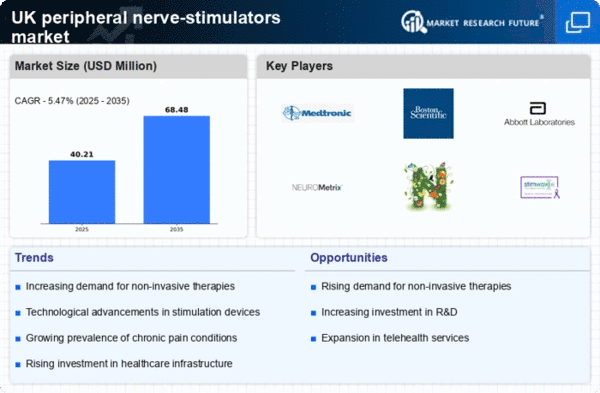

Technological advancements in medical devices are significantly influencing the peripheral nerve-stimulators market. Innovations such as miniaturization, wireless connectivity, and improved battery life are enhancing the functionality and usability of these devices. For instance, the introduction of implantable stimulators with remote monitoring capabilities allows for better patient management and adherence to treatment protocols. The UK market has seen a surge in the adoption of these advanced devices, with estimates suggesting a growth rate of around 15% annually. This trend indicates a strong preference for cutting-edge technology among healthcare providers and patients alike, further propelling the demand for peripheral nerve stimulators as effective therapeutic options.

Rising Focus on Non-Pharmacological Treatments

There is a growing emphasis on non-pharmacological treatments in the UK healthcare system, which is positively impacting the peripheral nerve-stimulators market. As concerns about opioid dependency and side effects of traditional pain medications rise, healthcare providers are increasingly exploring alternative therapies. Peripheral nerve stimulators offer a non-invasive option for pain relief, aligning with the shift towards holistic and patient-centered care. This trend is supported by clinical guidelines advocating for the use of neuromodulation techniques in pain management. The market is likely to benefit from this paradigm shift, as more practitioners recognize the value of incorporating peripheral nerve stimulators into treatment plans, thereby expanding their application across various patient populations.

Increased Investment in Healthcare Infrastructure

Investment in healthcare infrastructure in the UK is another critical driver for the peripheral nerve-stimulators market. The government and private sector are allocating substantial resources to enhance healthcare facilities and services, which includes the integration of advanced medical technologies. This investment is aimed at improving patient care and outcomes, particularly in pain management and rehabilitation. As hospitals and clinics upgrade their equipment and treatment protocols, the demand for peripheral nerve stimulators is expected to rise. Reports indicate that healthcare spending in the UK is projected to increase by 5% annually, creating a conducive environment for the growth of the peripheral nerve-stimulators market as healthcare providers seek to adopt innovative solutions.