Growth of Alternative Payment Methods

This market is increasingly characterized by the emergence of alternative payment methods., which are gaining traction among consumers. In the UK, services such as Buy Now Pay Later (BNPL) and cryptocurrencies are becoming more popular, appealing to a diverse range of consumers. Data suggests that BNPL options have seen a growth rate of 30% in recent years, indicating a shift in consumer preferences towards flexible payment solutions. This trend is prompting traditional payment providers to adapt their offerings to remain competitive. As alternative payment methods continue to proliferate, the payment service market is likely to evolve, necessitating a reevaluation of existing payment infrastructures to accommodate these new options.

Consumer Demand for Seamless Transactions

Consumer expectations are evolving, with a growing demand for seamless and instantaneous payment experiences. In the UK, the payment service market is responding to this trend by offering solutions that facilitate quick transactions, such as one-click payments and instant bank transfers. Research indicates that 70% of consumers prefer payment methods that allow for immediate transaction confirmation. This shift is prompting businesses to adopt more efficient payment solutions to meet customer expectations. Additionally, the rise of subscription-based services is further driving the need for automated payment systems, which can enhance customer retention and satisfaction. As consumer preferences continue to shape the landscape, The market must adapt to provide the desired level of convenience and speed..

Increased Focus on Security and Compliance

Security concerns remain a paramount issue within the payment service market, particularly in the UK, where regulatory compliance is stringent. The implementation of the Payment Services Directive 2 (PSD2) has introduced new requirements for secure payment processing, compelling service providers to enhance their security measures. As a result, the market is witnessing a surge in investments in cybersecurity technologies, with companies allocating up to 15% of their IT budgets to security enhancements. This focus on security not only protects consumers but also builds trust in payment systems, which is essential for market growth. Furthermore, as cyber threats evolve, the payment service market must continuously innovate to stay ahead of potential vulnerabilities.

Technological Advancements in Payment Solutions

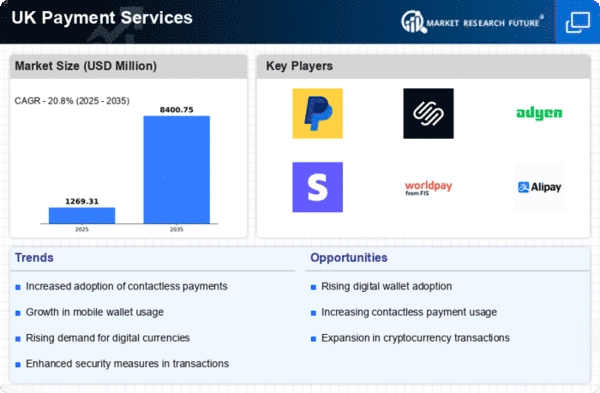

This market is experiencing a notable transformation. due to rapid technological advancements. Innovations such as contactless payments, mobile wallets, and blockchain technology are reshaping how transactions are conducted. In the UK, the adoption of contactless payments has surged, with over 50% of all card transactions now being contactless. This shift not only enhances consumer convenience but also drives efficiency in payment processing. Furthermore, the integration of artificial intelligence in fraud detection systems is becoming increasingly prevalent, providing a robust layer of security for both consumers and businesses. As technology continues to evolve, This market is likely to witness further enhancements., potentially leading to a more streamlined and secure transaction environment.

Expansion of E-commerce and Digital Marketplaces

The expansion of e-commerce and digital marketplaces is significantly influencing the payment service market. In the UK, online retail sales have increased dramatically, accounting for over 30% of total retail sales. This growth is driving demand for efficient payment solutions that cater to online transactions. As businesses increasingly shift to digital platforms, the need for integrated payment systems that support various payment methods becomes critical. Moreover, the rise of cross-border e-commerce is further complicating payment processing, as businesses must navigate different currencies and regulations. Consequently, This market is adapting to these challenges. by developing solutions that facilitate seamless international transactions, thereby enhancing the overall consumer experience.