Focus on Preventive Care

The patient access-solutions market is increasingly focused on preventive care. Healthcare systems aim to reduce long-term costs and improve patient outcomes. In the UK, there is a growing recognition of the importance of early intervention and preventive measures in managing health conditions. This shift is driving the demand for patient access solutions that facilitate regular health screenings, wellness programs, and educational resources. By promoting preventive care, healthcare providers can enhance patient engagement and reduce the burden on acute care services. Consequently, the patient access-solutions market is likely to expand as more organizations prioritize preventive strategies in their service offerings.

Rising Consumer Expectations

Rising consumer expectations are significantly influencing the patient access-solutions market. Patients today are more informed and demand greater transparency and convenience in their healthcare experiences. In the UK, surveys indicate that over 70% of patients prefer digital solutions for booking appointments and accessing medical information. This shift in consumer behavior is prompting healthcare providers to enhance their patient access solutions, ensuring they meet the evolving expectations of their clientele. As a result, the market is likely to see an increase in the development of user-friendly platforms that facilitate seamless interactions between patients and healthcare services.

Government Initiatives and Funding

Government initiatives and funding play a crucial role in the patient access-solutions market. The UK government has been actively investing in healthcare infrastructure to improve patient access to services. For instance, the NHS Long Term Plan outlines significant funding allocations aimed at enhancing digital health solutions and patient engagement strategies. This commitment is expected to increase the adoption of patient access solutions by healthcare providers, as they seek to align with government objectives. Furthermore, the potential for public-private partnerships may lead to innovative solutions that address access challenges, thereby fostering growth in the patient access-solutions market.

Increasing Demand for Accessibility

The patient access-solutions market is driven by a growing demand for accessibility in healthcare services. With an aging population and a rise in chronic diseases, there is an increasing need for solutions that cater to diverse patient needs. In the UK, approximately 18% of the population is over 65 years old, which necessitates more accessible healthcare options. This demographic shift is prompting healthcare providers to adopt patient access solutions that ensure equitable access to services, regardless of geographical location or socioeconomic status. Consequently, the market is likely to expand as healthcare systems strive to meet these accessibility demands, thereby enhancing patient outcomes and satisfaction.

Technological Advancements in Healthcare

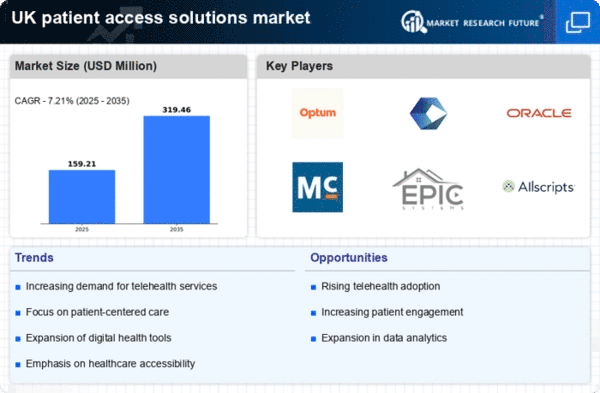

The patient access-solutions market is experiencing a surge due to rapid technological advancements in healthcare. Innovations such as telemedicine, electronic health records (EHR), and mobile health applications are enhancing patient engagement and streamlining access to services. In the UK, the integration of artificial intelligence (AI) and machine learning in patient access solutions is expected to improve operational efficiency by up to 30%. This technological evolution not only facilitates better communication between patients and healthcare providers but also optimizes resource allocation, thereby reducing wait times and improving overall patient satisfaction. As these technologies continue to evolve, they are likely to play a pivotal role in shaping the future of the patient access-solutions market.