Increased Focus on Data Security

Data security concerns are becoming increasingly paramount for organizations across various sectors in the UK. The modular data-center market is responding to this heightened focus by offering solutions that enhance security measures. Modular data centers can be designed with advanced security features, including physical barriers and robust access controls, which are essential for protecting sensitive information. As cyber threats evolve, businesses are compelled to invest in infrastructure that not only supports operational needs but also safeguards data integrity. The modular data-center market is likely to see growth as companies prioritize secure environments for their data operations. This trend is further supported by regulatory requirements that mandate stringent data protection measures, compelling organizations to adopt modular solutions that can be tailored to meet compliance standards.

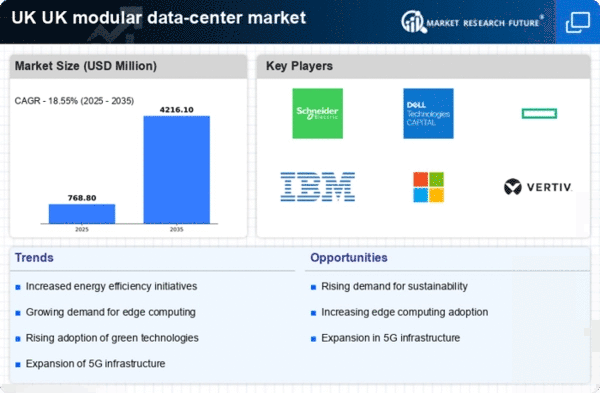

Rising Demand for Edge Computing

The increasing reliance on edge computing is a notable driver for the modular data-center market. As businesses seek to process data closer to the source, modular data centers offer a flexible and efficient solution. The UK has seen a surge in data generation, with estimates suggesting that data traffic could increase by over 30% annually. This trend necessitates the deployment of modular data centers to support local data processing needs, thereby enhancing response times and reducing latency. The modular data-center market is well-positioned to cater to this demand, providing scalable solutions that can be rapidly deployed in various locations. As industries such as IoT and smart cities expand, the need for localized data processing will likely continue to grow, further driving the modular data-center market in the UK.

Cost Efficiency and Operational Flexibility

Cost efficiency remains a critical driver for the modular data-center market. Businesses in the UK are increasingly looking for ways to optimize their IT expenditures. Modular data centers provide a cost-effective alternative to traditional data centers, allowing companies to invest in infrastructure that scales with their needs. The modular approach enables organizations to avoid the high upfront costs associated with building large facilities. Reports indicate that modular solutions can reduce capital expenditures by up to 20%, making them an attractive option for businesses aiming to enhance their operational flexibility. This financial advantage is particularly appealing in a competitive market where companies must balance performance with budget constraints. As a result, the modular data-center market is likely to experience sustained growth as more organizations recognize the potential for cost savings and operational agility.

Government Support for Digital Infrastructure

Government initiatives aimed at enhancing digital infrastructure are significantly influencing the modular data-center market. The UK government has prioritized investments in technology and digital services, with funding allocated to improve connectivity and data management capabilities. This support is expected to bolster the deployment of modular data centers, which can be rapidly constructed and integrated into existing networks. The modular data-center market stands to benefit from these initiatives, as they align with national goals of increasing digital resilience and fostering innovation. Furthermore, the government's commitment to sustainability and energy efficiency may encourage the adoption of modular solutions that meet these criteria. As public sector projects ramp up, the demand for modular data centers is likely to rise, creating new opportunities for growth within the market.

Technological Advancements in Modular Designs

Technological advancements are driving innovation within the modular data-center market. The development of more efficient cooling systems, energy management technologies, and modular construction techniques is enhancing the appeal of these solutions. In the UK, the push for energy-efficient data centers is particularly relevant, as businesses seek to reduce their carbon footprints. Innovations such as liquid cooling and AI-driven energy management systems are becoming integral to modular designs, allowing for improved performance and sustainability. The modular data-center market is likely to benefit from these advancements, as they enable operators to optimize energy consumption and reduce operational costs. As technology continues to evolve, the market may witness the emergence of even more sophisticated modular solutions that cater to the growing demands for efficiency and sustainability.