Government Initiatives and Funding

Government initiatives aimed at improving healthcare infrastructure in the UK are significantly impacting the metal implants-medical-alloys market. Increased funding for medical research and development is fostering innovation in implant technologies. The UK government has allocated substantial resources to support the advancement of medical devices, which includes metal implants. This financial backing is likely to encourage collaborations between academic institutions and industry players, leading to the development of cutting-edge solutions. As a result, the market may experience accelerated growth, with an estimated increase in investment in the sector projected to reach £500 million by 2027.

Innovations in Biocompatible Materials

The development of new biocompatible materials is a key driver in the metal implants-medical-alloys market. Research institutions and manufacturers are focusing on creating alloys that not only meet mechanical requirements but also promote better integration with human tissue. For instance, the introduction of magnesium-based alloys is gaining traction due to their biodegradability and potential to reduce long-term complications. This innovation could lead to a shift in material preferences within the industry, as healthcare providers seek to improve patient safety and satisfaction. The market is expected to see a notable increase in the adoption of these advanced materials, potentially enhancing overall market value.

Rising Demand for Orthopedic Procedures

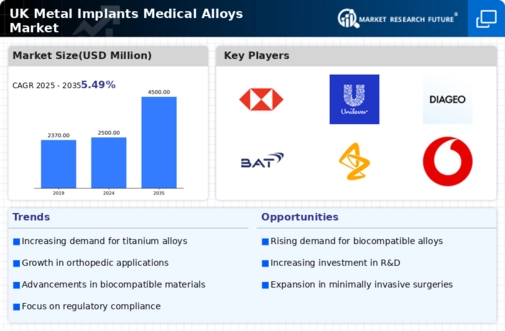

The increasing prevalence of orthopedic conditions in the UK is driving the demand for metal implants. As the population ages, the incidence of joint-related issues such as osteoarthritis is expected to rise. This trend suggests a growing need for metal implants, particularly those made from titanium and cobalt-chromium alloys, which are favored for their biocompatibility and strength. The metal implants-medical-alloys market is likely to benefit from this surge, with projections indicating a potential growth rate of around 6% annually in the coming years. Furthermore, advancements in surgical techniques and postoperative care are enhancing patient outcomes, thereby further stimulating the market.

Expansion of Sports Medicine Applications

The expansion of sports medicine is emerging as a significant driver for the metal implants-medical-alloys market. With a growing number of individuals participating in sports and physical activities, the incidence of sports-related injuries is on the rise. This trend necessitates the use of durable and reliable metal implants to aid in recovery and rehabilitation. Manufacturers are responding by developing specialized alloys that cater to the unique demands of sports medicine, such as lightweight and high-strength materials. The market is expected to grow as healthcare providers increasingly recognize the importance of effective treatment options for athletes, potentially leading to a market growth of around 7% over the next few years.

Growing Awareness of Minimally Invasive Surgeries

The rising awareness and preference for minimally invasive surgical techniques are influencing the metal implants-medical-alloys market. Patients and healthcare providers are increasingly opting for procedures that reduce recovery time and minimize scarring. This trend is prompting manufacturers to develop implants that are compatible with these techniques, such as smaller and more adaptable metal alloys. The market is likely to see a shift towards products that facilitate these surgeries, potentially increasing the demand for specialized metal implants. As a result, the market could witness a growth rate of approximately 5% annually as more healthcare facilities adopt these innovative approaches.