Aging Population

The demographic shift towards an aging population in the UK is a critical driver for the medical device market. As the proportion of elderly individuals increases, there is a corresponding rise in the prevalence of chronic diseases and age-related health issues. This demographic trend necessitates the development and adoption of medical devices tailored to the needs of older patients, such as mobility aids, monitoring devices, and home healthcare solutions. According to the Office for National Statistics, the number of people aged 65 and over is projected to reach 23 million by 2040, which will likely drive demand for innovative medical devices. Consequently, manufacturers are focusing on creating products that enhance the quality of life for this demographic, thereby expanding their market reach.

Regulatory Support

The regulatory environment in the UK medical device market plays a pivotal role in shaping market dynamics. The Medicines and Healthcare products Regulatory Agency (MHRA) has established a framework that facilitates the approval and monitoring of medical devices, ensuring safety and efficacy. Recent adaptations to regulations, including the introduction of the UKCA marking, aim to streamline the process for manufacturers while maintaining high standards. This supportive regulatory landscape encourages innovation and investment in the medical device sector. Furthermore, the UK government has been proactive in engaging with industry stakeholders to refine regulations, which may enhance the competitiveness of UK-based manufacturers in the global market. As a result, the regulatory framework is likely to foster growth and attract new entrants into the industry.

Technological Advancements

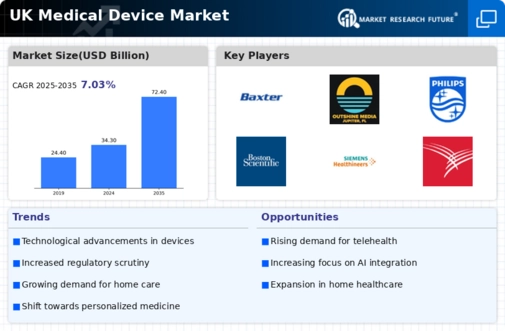

The UK medical device market is experiencing rapid technological advancements that are reshaping healthcare delivery. Innovations such as artificial intelligence, robotics, and telemedicine are becoming increasingly integrated into medical devices. For instance, the use of AI in diagnostic tools has shown to enhance accuracy and efficiency, potentially reducing the time required for patient assessments. The UK government has been supportive of these advancements, investing in research and development initiatives aimed at fostering innovation. As a result, the market is projected to grow significantly, with estimates suggesting a compound annual growth rate of around 5.4% from 2023 to 2028. This growth is indicative of the increasing reliance on advanced technologies in the medical device sector.

Increased Healthcare Expenditure

The UK medical device market is benefiting from increased healthcare expenditure, driven by both public and private sectors. The National Health Service (NHS) has been allocating more resources towards the procurement of advanced medical technologies to improve patient outcomes. In the 2021-2022 financial year, NHS spending on medical devices was reported to be over £5 billion, reflecting a commitment to enhancing healthcare delivery. This trend is expected to continue, with the government aiming to increase overall healthcare spending by 3.5% annually. Such financial support not only bolsters the demand for innovative medical devices but also encourages manufacturers to invest in research and development. Consequently, this increased expenditure is likely to stimulate growth within the medical device market.

Rising Demand for Home Healthcare Solutions

The UK medical device market is witnessing a rising demand for home healthcare solutions, driven by changing patient preferences and advancements in technology. Patients increasingly prefer receiving care in the comfort of their homes, which has led to a surge in the development of medical devices designed for home use. This includes remote monitoring devices, telehealth platforms, and portable diagnostic tools. The UK government has recognized this trend and is promoting initiatives that support home healthcare, aiming to reduce hospital admissions and improve patient outcomes. Market data indicates that the home healthcare market is expected to grow at a compound annual growth rate of 7.5% over the next five years. This shift towards home-based care is likely to create new opportunities for manufacturers in the medical device sector.