Rising Need for Cost Efficiency

The laboratory automation market is being propelled by the rising need for cost efficiency among laboratories. As operational costs continue to escalate, particularly in the UK, laboratories are increasingly turning to automation to reduce labor costs and improve resource allocation. Automation technologies can significantly lower the cost per test, making it financially viable for laboratories to expand their testing capabilities. This trend is underscored by a market analysis indicating that automation can reduce operational costs by up to 30%. As laboratories strive to maintain profitability while meeting growing demand, the laboratory automation market is likely to see sustained growth driven by this imperative for cost efficiency.

Technological Advancements in Automation

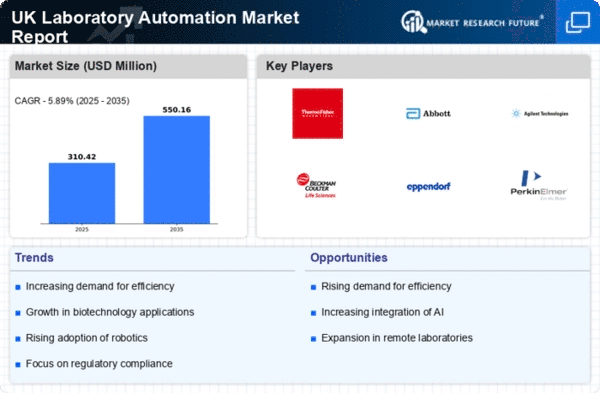

The laboratory automation market is experiencing a surge in technological advancements, particularly in robotics and software integration. Innovations such as automated liquid handling systems and advanced data management software are streamlining laboratory processes. In the UK, the market is projected to grow at a CAGR of approximately 10% from 2025 to 2030, driven by the need for increased efficiency and accuracy in laboratory operations. These advancements not only enhance productivity but also reduce human error, which is crucial in sensitive laboratory environments. As laboratories seek to improve throughput and reliability, the adoption of these technologies is likely to accelerate, further propelling the laboratory automation market.

Expansion of Biobanking and Genomic Research

The laboratory automation market is benefiting from the expansion of biobanking and genomic research initiatives in the UK. As the demand for biological samples and genomic data increases, laboratories are investing in automation to manage large volumes of samples efficiently. This trend is particularly relevant in the context of personalized medicine, where automated systems facilitate the processing and analysis of genetic material. The market for laboratory automation is projected to grow significantly, with estimates suggesting an increase in value to over £1.5 billion by 2027. The integration of automation in biobanking and genomic research is likely to enhance operational efficiency and data accuracy, further driving the laboratory automation market.

Growing Focus on Data Integrity and Management

In the laboratory automation market, there is a growing emphasis on data integrity and management, particularly in regulated industries such as pharmaceuticals and biotechnology. The UK regulatory landscape mandates stringent data management practices, which are increasingly being addressed through automation solutions. Laboratories are adopting automated systems that ensure compliance with Good Laboratory Practice (GLP) and Good Manufacturing Practice (GMP) standards. This focus on data integrity is expected to drive market growth, as organizations seek to mitigate risks associated with data breaches and inaccuracies. The laboratory automation market is thus likely to expand as more laboratories invest in solutions that enhance data security and compliance.

Increased Demand for High-Throughput Screening

The laboratory automation market is witnessing a heightened demand for high-throughput screening (HTS) technologies, particularly in drug discovery and development. In the UK, pharmaceutical companies are increasingly investing in automation to expedite the screening process, which can involve testing thousands of compounds. This trend is reflected in the market's growth, with estimates suggesting a value of over £1 billion by 2026. The ability to conduct rapid and efficient screenings not only shortens development timelines but also enhances the potential for discovering new therapeutics. Consequently, the laboratory automation market is likely to benefit from this growing emphasis on HTS, as laboratories strive to remain competitive.