Regulatory Framework and Compliance

The regulatory landscape surrounding infection control in the UK is becoming increasingly stringent, which is influencing the UK infection control human and animal health market. Compliance with regulations set forth by bodies such as the Care Quality Commission (CQC) and the Veterinary Medicines Directorate (VMD) is essential for healthcare providers and veterinary practices. These regulations mandate the implementation of specific infection control protocols, thereby driving demand for compliant products and services. In 2025, the enforcement of new guidelines aimed at reducing healthcare-associated infections (HAIs) has prompted facilities to invest in updated infection control measures. This regulatory pressure is likely to sustain market growth as organizations strive to meet compliance standards and enhance patient safety.

Growing Awareness of Infection Control

The UK infection control human and animal health market is experiencing a notable increase in awareness regarding the importance of infection control measures. This heightened awareness is driven by various factors, including public health campaigns and educational initiatives aimed at both healthcare professionals and the general public. As a result, there is a growing demand for infection control products and services, which is expected to boost market growth. The UK government has also emphasized the need for effective infection control strategies, particularly in healthcare settings, which further propels the market. In 2025, the market was valued at approximately GBP 1.5 billion, indicating a robust growth trajectory as stakeholders recognize the critical role of infection control in safeguarding public health.

Investment in Healthcare Infrastructure

Investment in healthcare infrastructure within the UK is playing a pivotal role in shaping the infection control human and animal health market. The government has committed substantial resources to enhance healthcare facilities, which includes upgrading infection control systems. This investment is aimed at improving patient outcomes and reducing the burden of healthcare-associated infections. In 2025, the UK government allocated approximately GBP 500 million towards infection control initiatives, reflecting a strong commitment to public health. As healthcare facilities expand and modernize, the demand for advanced infection control products and services is likely to increase, thereby fostering growth in the market. This trend underscores the importance of a well-funded healthcare system in supporting effective infection control practices.

Rising Incidence of Infectious Diseases

The UK infection control human and animal health market is significantly influenced by the rising incidence of infectious diseases. Factors such as increased global travel, urbanization, and changing environmental conditions contribute to the spread of pathogens. The UK has witnessed a rise in zoonotic diseases, which are transmitted from animals to humans, necessitating robust infection control measures in both healthcare and veterinary settings. In 2025, the prevalence of certain infectious diseases has prompted public health authorities to prioritize infection control initiatives. This trend is expected to drive market growth as healthcare providers and animal health practitioners seek effective solutions to mitigate the risks associated with infectious diseases, thereby enhancing overall public health.

Technological Advancements in Infection Control

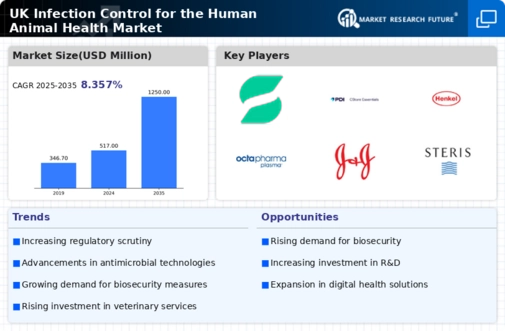

The integration of advanced technologies within the UK infection control human and animal health market is transforming traditional practices. Innovations such as automated disinfection systems, real-time monitoring devices, and advanced sterilization techniques are becoming increasingly prevalent. These technologies not only enhance the efficacy of infection control measures but also streamline processes, thereby reducing human error. The market for these technologies is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of around 8% over the next five years. As healthcare facilities and veterinary practices adopt these advanced solutions, the overall effectiveness of infection control protocols is likely to improve, leading to better health outcomes for both humans and animals.