Growing Focus on Population Health Management

The growing focus on population health management is significantly influencing the healthcare analytics market. As healthcare providers in the UK strive to improve health outcomes for specific populations, the demand for analytics solutions that can identify trends and risk factors is on the rise. This shift towards a more holistic approach to health management is expected to propel the market forward, with estimates suggesting a potential market size of £1.5 billion by 2026. By utilising analytics to monitor population health metrics, healthcare organisations can implement targeted interventions, ultimately enhancing the quality of care delivered within the healthcare analytics market.

Regulatory Support and Compliance Initiatives

Regulatory support and compliance initiatives are playing a crucial role in shaping the healthcare analytics market. The UK government has implemented various policies aimed at promoting the use of analytics in healthcare settings, thereby ensuring that data is used responsibly and ethically. These initiatives are designed to enhance patient safety and data security, which are paramount in the healthcare sector. As a result, healthcare organisations are increasingly investing in analytics solutions that comply with regulatory standards. This trend is likely to drive market growth, as compliance not only mitigates risks but also fosters trust among patients and stakeholders in the healthcare analytics market.

Rising Demand for Data-Driven Decision Making

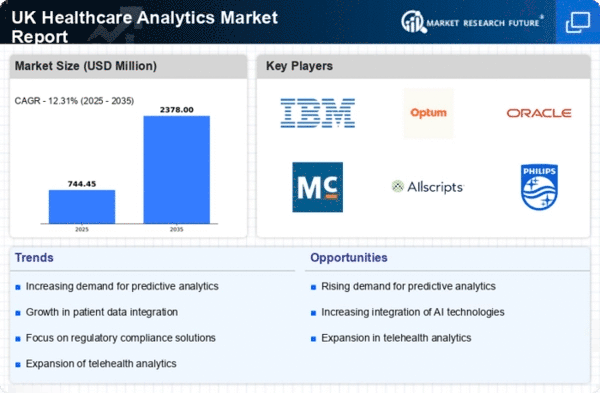

The healthcare analytics market is experiencing a notable surge in demand for data-driven decision making. This trend is largely attributed to the increasing need for healthcare providers to enhance operational efficiency and improve patient outcomes. In the UK, healthcare organisations are increasingly leveraging analytics to derive insights from vast amounts of data generated daily. According to recent estimates, the market is projected to grow at a CAGR of approximately 25% over the next five years. This growth is driven by the necessity for healthcare professionals to make informed decisions based on real-time data analysis, thereby fostering a culture of evidence-based practice within the healthcare analytics market.

Increased Investment in Health IT Infrastructure

Increased investment in health IT infrastructure is a key driver of the healthcare analytics market. The UK government and private sector are allocating substantial resources to upgrade and modernise healthcare IT systems, which is essential for effective data collection and analysis. This investment is expected to facilitate the integration of advanced analytics tools, thereby improving the overall efficiency of healthcare delivery. Reports indicate that the health IT market in the UK could reach £4 billion by 2025, with a significant portion of this funding directed towards enhancing analytics capabilities. Such advancements are likely to bolster the healthcare analytics market, enabling providers to harness the full potential of their data.

Integration of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) technologies is transforming the healthcare analytics market. These advanced technologies enable healthcare providers to analyse complex datasets more efficiently, leading to improved diagnostic accuracy and treatment outcomes. In the UK, the adoption of AI-driven analytics tools is expected to increase significantly, with projections indicating that the market could reach £2 billion by 2027. This integration not only streamlines data processing but also enhances predictive capabilities, allowing for proactive patient management and resource allocation within the healthcare analytics market.