Increased Data Generation

The exponential growth of data generation in the UK is a significant catalyst for the data center-infrastructure market. With the proliferation of IoT devices, social media, and digital transactions, data creation is projected to increase by over 40% annually. This surge necessitates enhanced data storage and processing capabilities, compelling organizations to upgrade their data center infrastructure. As businesses strive to harness insights from vast datasets, the demand for advanced analytics and real-time processing becomes paramount. Consequently, data centers must evolve to accommodate larger volumes of data while ensuring security and compliance. The data center-infrastructure market is thus likely to expand as companies invest in innovative solutions to manage and analyze the ever-growing data landscape.

Focus on Energy Efficiency

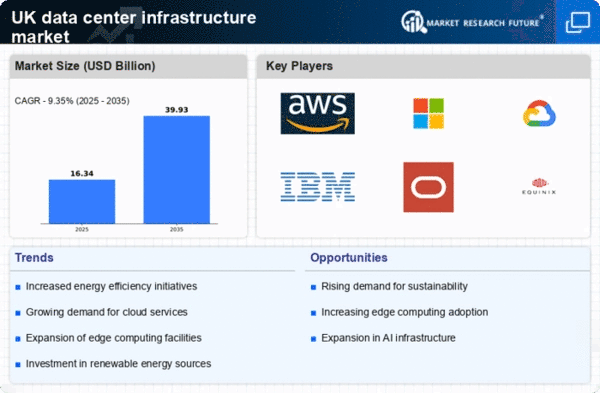

Energy efficiency has become a critical concern for the data center-infrastructure market, particularly in the UK, where sustainability initiatives are gaining traction. As energy costs rise and environmental regulations tighten, data center operators are increasingly prioritizing energy-efficient designs and technologies. It is estimated that energy-efficient data centers can reduce operational costs by up to 30%, making them more attractive to businesses. This focus on sustainability not only aligns with corporate social responsibility goals but also enhances the overall competitiveness of data centers. Consequently, the data center-infrastructure market is likely to witness a surge in demand for energy-efficient solutions, including advanced cooling systems and renewable energy sources, as organizations strive to minimize their carbon footprint.

Growth of Hybrid IT Environments

The shift towards hybrid IT environments is a notable driver for the data center-infrastructure market. Many organizations in the UK are adopting a combination of on-premises and cloud solutions to optimize their IT strategies. This hybrid approach allows businesses to maintain control over sensitive data while leveraging the scalability of cloud services. As a result, the demand for data center infrastructure that can seamlessly integrate with cloud platforms is increasing. In 2025, it is projected that hybrid IT solutions will account for nearly 40% of enterprise IT spending in the UK. This trend compels data center operators to enhance their infrastructure capabilities to support diverse workloads and ensure interoperability between on-premises and cloud environments, thereby driving growth in the data center-infrastructure market.

Rising Demand for Cloud Services

The increasing reliance on cloud computing is a pivotal driver for the data center-infrastructure market. As businesses in the UK transition to cloud-based solutions, the demand for robust data center infrastructure intensifies. In 2025, it is estimated that cloud services will account for approximately 30% of IT spending in the UK, highlighting the necessity for scalable and efficient data centers. This shift not only enhances operational efficiency but also necessitates advanced infrastructure to support the growing data loads. Consequently, data center operators are compelled to invest in high-performance servers, storage solutions, and networking equipment to meet the evolving needs of cloud service providers. The data center-infrastructure market is thus positioned to experience substantial growth as organizations seek to leverage cloud technologies for competitive advantage.

Technological Advancements in Infrastructure

Technological innovations are reshaping the data center-infrastructure market, driving the adoption of cutting-edge solutions. The emergence of AI, machine learning, and automation technologies is enabling data centers to operate more efficiently and effectively. In 2025, it is anticipated that over 25% of data centers in the UK will implement AI-driven management systems to optimize resource allocation and energy consumption. These advancements not only enhance operational efficiency but also reduce costs associated with energy and maintenance. As organizations seek to leverage these technologies, the data center-infrastructure market is poised for growth, with investments directed towards modernizing existing facilities and integrating smart technologies to improve performance and reliability.