Increased Healthcare Expenditure

The rise in healthcare expenditure in the UK is a significant factor influencing the UK Cardiac Output Monitoring Device Market. The UK government has committed to increasing the NHS budget, which is projected to reach over 200 billion GBP by 2024. This increase in funding allows for the procurement of advanced medical devices, including cardiac output monitoring systems. Furthermore, the emphasis on improving patient care and outcomes has led to greater investment in innovative technologies. As healthcare facilities upgrade their equipment to meet modern standards, the demand for cardiac output monitoring devices is expected to grow. This trend indicates a positive outlook for the UK Cardiac Output Monitoring Device Market, as financial resources are allocated towards enhancing cardiovascular care.

Regulatory Support and Guidelines

Regulatory support and clear guidelines are essential drivers for the UK Cardiac Output Monitoring Device Market. The Medicines and Healthcare products Regulatory Agency (MHRA) plays a pivotal role in ensuring the safety and efficacy of medical devices in the UK. The establishment of streamlined approval processes for innovative cardiac monitoring technologies has encouraged manufacturers to invest in the market. Additionally, the UK government has implemented policies that promote the adoption of advanced medical devices within the NHS. This regulatory environment fosters innovation and instills confidence among healthcare providers regarding the use of cardiac output monitoring devices. As a result, the UK Cardiac Output Monitoring Device Market is likely to benefit from ongoing regulatory support, facilitating the introduction of new products and technologies.

Growing Awareness of Preventive Healthcare

There is a notable shift towards preventive healthcare in the UK, which is significantly impacting the UK Cardiac Output Monitoring Device Market. Public health campaigns and educational initiatives have raised awareness about the importance of early detection and management of cardiovascular diseases. As individuals become more informed about their health, there is a growing demand for monitoring devices that facilitate proactive health management. The NHS has also been promoting preventive measures, encouraging patients to engage in regular health check-ups. This cultural shift towards prevention is likely to drive the adoption of cardiac output monitoring devices, as healthcare providers seek to equip patients with the tools necessary for effective self-management. Consequently, the UK Cardiac Output Monitoring Device Market is poised for growth as preventive healthcare becomes a priority.

Rising Prevalence of Cardiovascular Diseases

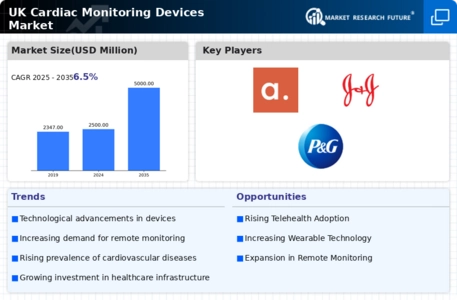

The increasing incidence of cardiovascular diseases in the UK is a primary driver for the UK Cardiac Output Monitoring Device Market. According to the British Heart Foundation, cardiovascular diseases account for a significant proportion of deaths in the UK, with approximately 160,000 fatalities annually. This alarming statistic underscores the urgent need for effective monitoring solutions. As healthcare providers seek to enhance patient outcomes, the demand for cardiac output monitoring devices is expected to rise. The National Health Service (NHS) has also recognized the importance of early detection and management of heart conditions, further propelling the market. Consequently, the UK Cardiac Output Monitoring Device Market is likely to experience substantial growth as healthcare systems prioritize cardiovascular health.

Technological Innovations in Monitoring Devices

Technological advancements play a crucial role in shaping the UK Cardiac Output Monitoring Device Market. Innovations such as non-invasive monitoring techniques and portable devices have emerged, enhancing the accuracy and convenience of cardiac assessments. For instance, the introduction of advanced sensors and algorithms has improved the precision of cardiac output measurements. The UK government has been supportive of research and development initiatives aimed at fostering innovation in medical technology. As a result, the market is witnessing a surge in the adoption of state-of-the-art devices that offer real-time monitoring capabilities. This trend is expected to continue, as healthcare providers increasingly seek to integrate cutting-edge technology into their practices, thereby driving the growth of the UK Cardiac Output Monitoring Device Market.