Advancements in Biologic Research

The biologic therapy market is seeing significant advancements in research methodologies and technologies. Innovations such as CRISPR and gene editing are paving the way for more targeted therapies, which could enhance treatment efficacy. In the UK, the National Institute for Health Research (NIHR) has reported increased funding for biologic research, indicating a commitment to developing new therapies. This influx of resources is likely to accelerate the introduction of novel biologics into the market, potentially leading to a market growth rate of around 8% annually. As researchers uncover new applications for biologics, the market is expected to expand, offering patients more effective treatment options.

Regulatory Support and Frameworks

The biologic therapy market benefits from a robust regulatory framework in the UK, which facilitates the approval and monitoring of biologic products. The Medicines and Healthcare products Regulatory Agency (MHRA) plays a crucial role in ensuring that biologics meet safety and efficacy standards. Recent initiatives aimed at streamlining the approval process for biologics may enhance market accessibility. For instance, the MHRA has introduced adaptive licensing pathways, which could shorten the time to market for innovative therapies. This supportive regulatory environment is likely to encourage investment in biologic therapies, fostering a competitive landscape that could see a market growth of approximately 6% over the next few years.

Rising Patient Awareness and Demand

The biologic therapy market is experiencing a shift in patient awareness and demand for advanced treatment options. As patients become more informed about their health conditions and available therapies, there is a growing inclination towards biologics, which are often perceived as more effective. Patient advocacy groups in the UK are playing a pivotal role in educating the public about the benefits of biologic therapies. This increased awareness is likely to drive demand, with estimates suggesting a market growth of approximately 6% as more patients seek out these innovative treatments. The shift in patient preferences is reshaping the landscape of the biologic therapy market.

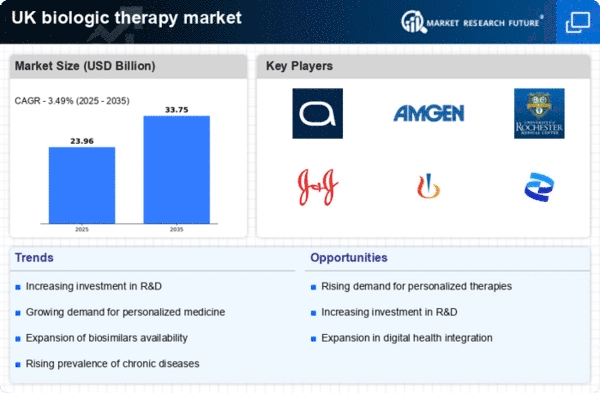

Increasing Prevalence of Chronic Diseases

The biologic therapy market is significantly influenced by the rising prevalence of chronic diseases such as rheumatoid arthritis, psoriasis, and inflammatory bowel disease in the UK. According to the National Health Service (NHS), the number of patients diagnosed with these conditions has been steadily increasing, leading to a higher demand for effective treatment options. Biologics have shown considerable promise in managing these diseases, often providing better outcomes than traditional therapies. This growing patient population is expected to drive the biologic therapy market, with projections indicating a potential market expansion of around 7% as healthcare providers seek to offer advanced treatment solutions.

Collaboration Between Industry and Academia

The biologic therapy market is experiencing a notable trend of collaboration between industry players and academic institutions in the UK. These partnerships are fostering innovation and accelerating the development of new biologic therapies. Universities are increasingly involved in research that leads to the discovery of novel biologics, while pharmaceutical companies provide the necessary funding and resources for clinical trials. This synergy is likely to enhance the pipeline of biologic products, potentially leading to a market growth rate of 5% as new therapies are introduced. Such collaborations not only benefit the market but also contribute to the overall advancement of medical science.