Growing Demand for Automation

The UK artificial neural network market is experiencing a notable surge in demand for automation across various sectors. Businesses are increasingly adopting artificial intelligence solutions to enhance operational efficiency and reduce costs. According to recent data, the automation market in the UK is projected to reach approximately 25 billion GBP by 2026, indicating a robust growth trajectory. This trend is particularly evident in manufacturing and logistics, where neural networks are utilized for predictive maintenance and supply chain optimization. As organizations seek to streamline processes and improve productivity, the integration of artificial neural networks becomes essential, driving further investment and innovation within the UK artificial neural network market.

Supportive Government Policies

The UK government has implemented several supportive policies aimed at promoting the growth of the artificial intelligence sector, which includes the artificial neural network market. Initiatives such as the UK AI Strategy emphasize the importance of AI in driving economic growth and enhancing public services. The government has allocated significant resources to support research and development in AI technologies, with a focus on ethical considerations and responsible innovation. This regulatory environment fosters a conducive atmosphere for businesses to invest in artificial neural networks, thereby stimulating growth within the UK artificial neural network market. As a result, companies are more likely to explore and adopt neural network solutions to meet evolving market demands.

Increased Focus on Data Privacy

As the UK artificial neural network market expands, there is an increasing focus on data privacy and security. With the implementation of regulations such as the General Data Protection Regulation (GDPR), organizations are compelled to ensure that their AI systems, including neural networks, comply with stringent data protection standards. This emphasis on privacy is driving the development of more secure and transparent AI solutions. Companies are investing in technologies that enhance data governance and ethical AI practices, which are becoming critical factors in the adoption of artificial neural networks. Consequently, the UK artificial neural network market is likely to see a shift towards solutions that prioritize data privacy while maintaining performance and efficiency.

Advancements in Machine Learning

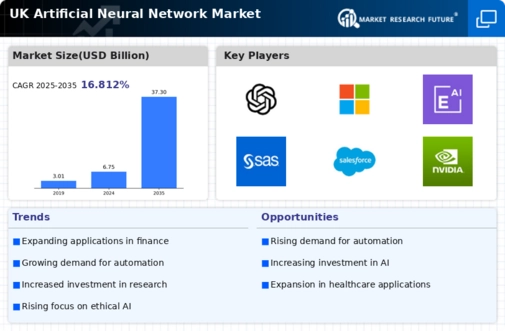

Recent advancements in machine learning technologies are significantly influencing the UK artificial neural network market. The development of more sophisticated algorithms and increased computational power has enabled the creation of highly efficient neural networks. For instance, the UK government has invested heavily in AI research, with funding exceeding 1 billion GBP aimed at fostering innovation in machine learning. This investment is likely to accelerate the deployment of artificial neural networks in various applications, including finance, healthcare, and retail. As organizations leverage these advancements to gain competitive advantages, the demand for machine learning solutions within the UK artificial neural network market is expected to grow substantially.

Rising Investment in AI Startups

The UK artificial neural network market is witnessing a surge in investment directed towards AI startups. Venture capital funding for AI-related companies has reached unprecedented levels, with estimates suggesting that over 2 billion GBP was invested in 2025 alone. This influx of capital is enabling startups to innovate and develop cutting-edge neural network applications across various sectors, including healthcare, finance, and transportation. As these startups emerge and grow, they contribute to the overall expansion of the UK artificial neural network market. The competitive landscape is likely to evolve, with new players introducing novel solutions that challenge established companies, thereby driving further advancements in the field.