Growing Investment in Biopharmaceuticals

The antibodies market is benefiting from the growing investment in biopharmaceuticals within the UK. As pharmaceutical companies increasingly focus on biologics, the demand for monoclonal antibodies and other antibody-based therapies is on the rise. In 2025, the biopharmaceutical sector is projected to reach a valuation of £50 billion, with antibodies constituting a substantial portion of this market. This influx of capital is likely to facilitate research and development activities, leading to the introduction of novel therapies that address unmet medical needs. Furthermore, collaborations between academic institutions and industry players are expected to foster innovation in the antibodies market, enhancing the overall landscape of biopharmaceuticals in the UK.

Increasing Prevalence of Chronic Diseases

The antibodies market in the UK is experiencing growth due to the rising prevalence of chronic diseases such as cancer, autoimmune disorders, and infectious diseases. As the population ages, the incidence of these conditions is likely to increase, leading to a higher demand for therapeutic antibodies. According to recent estimates, chronic diseases account for approximately 70% of all deaths in the UK, which underscores the urgent need for effective treatment options. This trend is expected to drive innovation and investment in the antibodies market, as healthcare providers seek advanced therapies to improve patient outcomes. Furthermore, the increasing burden of these diseases on the healthcare system may prompt government initiatives aimed at enhancing access to antibody therapies, thereby further stimulating market growth.

Regulatory Support for Antibody Therapies

Regulatory support is a crucial driver for the antibodies market in the UK. The Medicines and Healthcare products Regulatory Agency (MHRA) has been actively streamlining the approval process for antibody-based therapies, which encourages pharmaceutical companies to invest in this area. The introduction of expedited pathways for innovative treatments is likely to reduce the time it takes for new therapies to reach the market. This regulatory environment not only fosters innovation but also enhances patient access to life-saving treatments. As the UK government continues to prioritize healthcare advancements, the antibodies market is expected to thrive, with an increasing number of therapies receiving timely approvals and entering the market.

Rising Public Awareness and Patient Advocacy

Public awareness and patient advocacy are emerging as significant drivers of the antibodies market in the UK. As patients become more informed about their treatment options, there is a growing demand for effective therapies, including antibody-based treatments. Advocacy groups are playing a vital role in raising awareness about chronic diseases and the potential benefits of antibody therapies. This heightened awareness is likely to influence healthcare policies and funding allocations, ultimately benefiting the antibodies market. Moreover, as patients actively engage in discussions about their healthcare, pharmaceutical companies may be encouraged to prioritize the development of innovative antibody therapies that align with patient needs and preferences.

Technological Advancements in Antibody Development

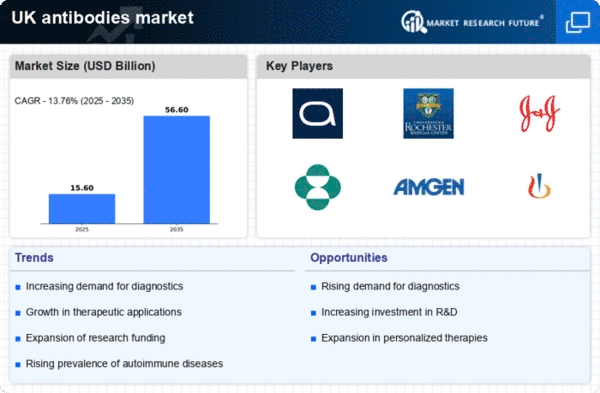

Technological advancements are playing a pivotal role in shaping the antibodies market in the UK. Innovations such as recombinant DNA technology, high-throughput screening, and bioinformatics are streamlining the process of antibody discovery and development. These technologies enable researchers to create more effective and targeted therapies, which are crucial in addressing complex diseases. The market is projected to witness a compound annual growth rate (CAGR) of around 8% over the next few years, driven by these advancements. Additionally, the integration of artificial intelligence in drug development processes is likely to enhance the efficiency of antibody production, reducing time and costs associated with bringing new therapies to market. As a result, the antibodies market is expected to expand significantly, offering a wider array of treatment options for patients.