Rising Consumer Expectations

Consumer expectations for faster and more reliable connectivity are significantly influencing the 5g system-integration market. As users increasingly rely on mobile devices for various applications, the demand for high-speed internet and low latency is paramount. In the UK, surveys indicate that over 70% of consumers prioritize connectivity quality when choosing service providers. This shift in consumer behaviour compels businesses to invest in advanced 5G system-integration solutions to meet these expectations. Moreover, the rise of streaming services, online gaming, and remote work necessitates robust network capabilities. Consequently, service providers are likely to enhance their offerings, thereby propelling the growth of the 5g system-integration market.

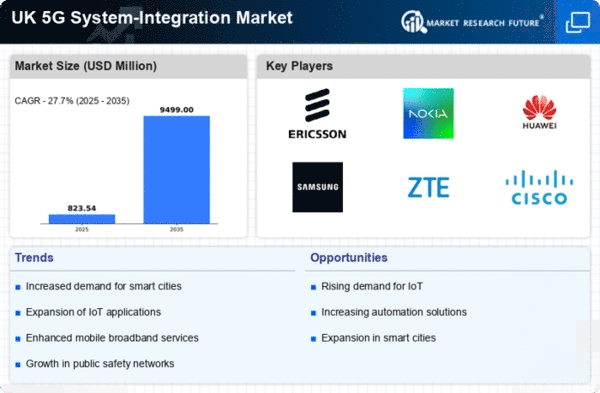

Expansion of IoT Applications

The proliferation of Internet of Things (IoT) devices is a key driver for the 5g system-integration market. As industries increasingly adopt IoT solutions, the demand for seamless connectivity and integration rises. In the UK, it is estimated that the number of connected IoT devices will reach 1.5 billion by 2025, necessitating robust 5G infrastructure. This growth is likely to enhance operational efficiency across sectors such as manufacturing, healthcare, and transportation. The integration of 5G technology with IoT applications can facilitate real-time data processing and analytics, thereby driving innovation. Consequently, businesses are investing heavily in 5G system-integration solutions to harness the full potential of IoT, which is projected to contribute significantly to the overall market growth.

Government Initiatives and Funding

Government initiatives aimed at enhancing digital infrastructure play a crucial role in the 5g system-integration market. The UK government has committed substantial funding to support the rollout of 5G technology, with investments exceeding £1 billion. These initiatives are designed to foster innovation, improve connectivity, and ensure that the UK remains competitive in the global digital economy. By providing financial support and regulatory frameworks, the government encourages private sector investment in 5G system-integration projects. This collaborative approach is expected to accelerate the deployment of 5G networks, thereby creating a conducive environment for market growth. As a result, businesses are more likely to adopt 5G solutions, further driving demand in the system-integration market.

Competitive Landscape and Innovation

The competitive landscape within the telecommunications sector is a driving force for the 5g system-integration market. As multiple players vie for market share, there is a heightened focus on innovation and differentiation. Companies are increasingly investing in research and development to create unique 5G solutions tailored to specific industry needs. In the UK, the presence of numerous startups and established firms fosters a dynamic environment that encourages technological advancements. This competition is likely to lead to the introduction of novel 5G system-integration products and services, enhancing overall market growth. Furthermore, partnerships and collaborations among industry stakeholders are expected to accelerate the development and deployment of 5G technologies, further stimulating the market.

Advancements in Network Infrastructure

Technological advancements in network infrastructure are pivotal for the growth of the 5g system-integration market. The transition from 4G to 5G involves significant upgrades in hardware and software, which are essential for supporting higher data rates and increased connectivity. In the UK, telecom operators are investing heavily in upgrading their infrastructure, with projections indicating a market value of £3 billion by 2026 for 5G-related investments. These advancements not only improve service quality but also enable the integration of new technologies such as edge computing and artificial intelligence. As a result, businesses are more inclined to adopt 5G system-integration solutions to leverage these innovations, thereby driving market expansion.