U S Cement Tiles Size

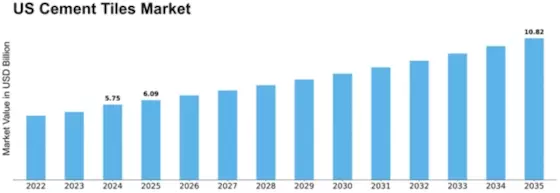

U.S. Cement Tiles Market Growth Projections and Opportunities

The U.S. cement tiles market is influenced by a variety of factors that collectively shape its dynamics. One of the primary drivers is the growing demand for aesthetically appealing and durable flooring solutions in both residential and commercial spaces. Cement tiles, known for their versatility, intricate designs, and durability, have gained popularity as a distinctive flooring option. The demand for cement tiles is driven by the desire for unique and customizable designs, as well as the increasing focus on sustainable and eco-friendly construction materials, contributing significantly to the growth of the U.S. cement tiles market.

Technological advancements and innovations in cement tile manufacturing play a pivotal role in market growth. Continuous research and development efforts focus on improving the production processes, color options, and design capabilities of cement tiles. Innovations in pigment technologies, mold manufacturing, and surface treatments contribute to the development of high-quality and visually appealing cement tiles that meet the evolving aesthetic preferences of consumers. Manufacturers strive to offer solutions that cater to the diverse needs of architects, designers, and homeowners.

The construction industry's health significantly influences the U.S. cement tiles market. Economic growth often leads to increased construction activities, driving the demand for innovative and customized building materials like cement tiles. Conversely, economic downturns or fluctuations in the real estate market may impact the construction sector, affecting the demand for cement tiles. The market's sensitivity to economic trends underscores the importance of monitoring the construction industry's health for stakeholders in the U.S. cement tiles industry.

Regulatory considerations and standards also play a crucial role in shaping the U.S. cement tiles market. Due to their use in residential and commercial construction, cement tiles may be subject to regulations concerning product safety, environmental impact, and compliance with building codes. Meeting these regulatory requirements is essential for cement tile manufacturers to ensure market acceptance and adherence to industry standards.

Raw material availability and pricing are critical considerations in the U.S. cement tiles market. The primary raw materials for cement tiles include Portland cement, sand, and pigments. Fluctuations in the prices and availability of these raw materials can impact the overall production cost of cement tiles. Manufacturers closely monitor raw material markets to adjust their strategies and maintain cost-effectiveness in the competitive market.

Geographical factors also play a role in shaping the U.S. cement tiles market. Different regions may have varying levels of construction activities, architectural preferences, and consumer demands for unique flooring solutions, influencing the demand for cement tiles. Areas with a strong focus on architectural design and sustainable building practices may experience higher demand for cement tiles products.

Environmental considerations are increasingly influencing the U.S. cement tiles market. As sustainability becomes a key factor in construction and design, there is a growing focus on developing eco-friendly cement tiles and adopting sustainable manufacturing processes. Manufacturers are exploring ways to enhance the environmental profile of cement tiles, including the use of recycled materials, responsible sourcing, and reducing the carbon footprint of production.

Consumer preferences for unique and customizable flooring options are driving the adoption of cement tiles in the U.S. market. The desire for personalized and visually striking interiors, coupled with the growing awareness of the environmental impact of construction materials, contributes to the popularity of cement tiles among homeowners and designers.

Leave a Comment