Market Share

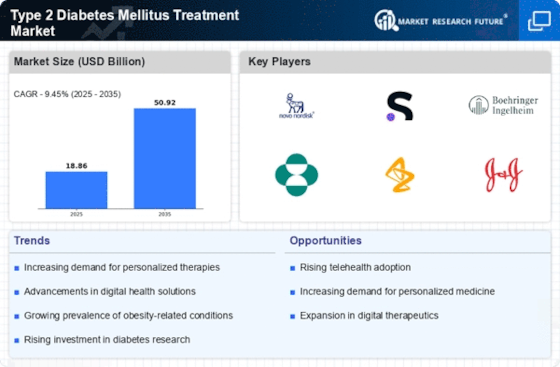

Introduction: Navigating the Competitive Landscape of Type 2 Diabetes Mellitus Treatment

The market for treatment of diabetes mellitus type 2 is experiencing an unprecedented level of competition, driven by a combination of technological advances, regulatory changes, and growing patient expectations for a bespoke approach to diabetes care. Several players, including pharmaceutical companies, digital health companies, and biotechnology companies, are vying for leadership with differentiated offerings. Artificial intelligence (AI) is enabling pharmaceutical companies to enhance the efficacy of their drugs and improve patient adherence. IT companies are developing platforms that combine the use of IoT devices with the use of artificial intelligence. Telemedicine and mobile applications are reshaping patient engagement strategies. The growth opportunities in certain regional markets, particularly in North America and Asia-Pacific, are unique. As a result, the strategic deployment of biometric and automation technology will be critical to winning market share in the coming years. Strategic leaders need to be aware of these developments to effectively navigate the complexities of this evolving landscape.

Competitive Positioning

Full-Suite Integrators

These vendors offer comprehensive solutions encompassing pharmaceuticals, diagnostics, and patient management.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Abbott Laboratories | Diverse product portfolio | Diagnostics and therapeutics | Global |

| Eli Lilly | Innovative diabetes therapies | Pharmaceuticals | North America, Europe |

| Novo Nordisk | Leader in insulin production | Insulin and GLP-1 therapies | Global |

| Sanofi | Strong diabetes portfolio | Pharmaceuticals | Global |

Specialized Technology Vendors

These companies focus on innovative technologies and solutions for diabetes management.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Becton Dickinson and Company | Advanced delivery systems | Injection devices | Global |

| Roche Diagnostics Ltd. | Leading in diabetes monitoring | Blood glucose monitoring | Global |

| Acon Laboratories, Inc. | Rapid testing solutions | Diagnostic tests | North America, Asia |

Pharmaceutical Innovators

These vendors are known for their research and development of new diabetes medications.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Amgen | Biotechnology expertise | Biopharmaceuticals | Global |

| AstraZeneca | Strong pipeline of diabetes drugs | Pharmaceuticals | Global |

| Boehringer Ingelheim | Innovative combination therapies | Pharmaceuticals | Global |

| Merck | Established diabetes treatments | Pharmaceuticals | Global |

| Novartis & Co. | Diverse therapeutic options | Pharmaceuticals | Global |

| Takeda Pharmaceuticals | Focus on metabolic diseases | Pharmaceuticals | Global |

Emerging Players

These vendors are focused on niche solutions and innovative approaches to diabetes treatment.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Adocia | Novel insulin formulations | Biopharmaceuticals | Europe, North America |

| Akros Pharma | Targeted therapies | Pharmaceuticals | North America |

| Biocon | Affordable biosimilars | Biosimilars | Asia, Global |

| Peptron | Innovative drug delivery systems | Pharmaceuticals | Asia, Global |

| Sunpharma | Cost-effective solutions | Pharmaceuticals | Asia, Global |

| Daiichi Sankyo | Research-driven approach | Pharmaceuticals | Global |

Emerging Players & Regional Champions

- Novo Nordisk (Denmark): Focused on GLP-1 receptor agonists and insulin therapies, recently expanded its digital health solutions for diabetes management, challenging established players like Sanofi by integrating technology with treatment.

- Boehringer Ingelheim (Germany): Offers SGLT2 inhibitors and has partnered with digital health companies to enhance patient engagement, complementing traditional therapies and competing with major brands like AstraZeneca.

- Zywie (USA): Specializes in remote monitoring solutions for diabetes management, recently secured contracts with healthcare providers to implement their platform, providing a tech-driven alternative to conventional treatment methods.

- Glooko (USA): Provides a diabetes management platform that integrates data from various devices, recently partnered with health systems to improve patient outcomes, challenging traditional care models by emphasizing data-driven insights.

- Insulet Corporation (USA): Known for its Omnipod insulin management system, has expanded its offerings to include automated insulin delivery systems, positioning itself as a competitor to established insulin pump manufacturers.

Regional Trends: In 2024 the use of digital health solutions increases, especially in Europe and North America, where the demand for individualized diabetes care is growing. The new players are using technology to increase patient involvement and adherence. The established players respond by integrating similar solutions into their offer. In Asia-Pacific, where there is a growing focus on prevention and lifestyle management, the regional champions develop local solutions that address cultural and dietary differences.

Collaborations & M&A Movements

- The agreement was made on the basis of a common goal of integrating continuous glucose monitors and insulin delivery systems to improve the patient’s health and diabetes management and thus strengthen their position in the market for type 2 diabetes treatments.

- Boehringer Ingelheim acquired the rights to a novel oral diabetes medication from a biotech firm, which is expected to expand their product portfolio and increase market share in the Type 2 Diabetes segment amidst growing competition.

- Sanofi and Google Health collaborated to leverage AI in developing personalized treatment plans for Type 2 Diabetes patients, aiming to improve patient adherence and outcomes, which could significantly enhance their market presence.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| Biometric Self-Boarding | Dexcom, Abbott | The continuous glucose monitoring system has been adopted by many patients who wish to keep track of their blood sugar levels. The Freestyle Libre has a simple, friendly design, which has led to an increase in home use, which demonstrates good patient compliance. |

| AI-Powered Ops Mgmt | Roche, Sanofi | Roche uses the power of artificial intelligence in its diabetes-management systems to optimize the delivery of insulin and improve patient outcomes. Sanofi’s digital tools for treating diabetes are based on artificial intelligence, which is enabling it to offer new and more individualized treatment plans. |

| Patient Education and Support | Novo Nordisk, Boehringer Ingelheim | With a comprehensive education and support, Novo Nordisk enables the patient to take care of his diabetes. With a digital platform, Boehringer Ingelheim is offering patient-tailored education and self-management. |

| Telehealth Integration | Lilly, Merck | In its diabetes care programs, Lilly has integrated telemedicine, enabling remote consultation and remote monitoring. Merck's digital health solutions facilitate continuous patient-doctor communication and thus help improve adherence to treatment. |

| Sustainability Initiatives | Johnson & Johnson, AstraZeneca | Having committed to sustainable manufacturing, Johnson & Johnson has reduced the environmental impact of its diabetes products. AstraZeneca's programmes for reducing its carbon footprint and promoting responsible sourcing are aligned with its public health goals. |

Conclusion: Navigating the Type 2 Diabetes Treatment Landscape

The Type 2 diabetes mellitus market is characterized by a high level of competition and a large number of fragmented segments. In the United States and Europe, the trend towards more individualized approaches to treatment is especially noticeable. Artificial intelligence (AI) for the purpose of predictive analysis, automation for the purpose of efficiency, and initiatives for the environment, meeting both regulatory requirements and consumer demands. These are the developments that will shape the market in the future, and the ability to be flexible in the product range and to respond to changing patient needs will be the most important success factors for market leadership. These companies that can successfully integrate these factors into their strategies will not only increase their competitiveness but also help to improve patient outcomes in the complex treatment landscape.

Leave a Comment