Supportive Regulatory Frameworks

The TV White Space Spectrum Market benefits from supportive regulatory frameworks that encourage the use of unused spectrum. Governments and regulatory bodies are increasingly recognizing the potential of TV white space technology to bridge the digital divide. For instance, the Federal Communications Commission (FCC) in the United States has established rules that facilitate the deployment of white space devices. This regulatory support not only fosters innovation but also attracts investments in the sector. As of 2025, the number of licensed white space devices has increased significantly, indicating a growing acceptance and integration of this technology into the telecommunications landscape.

Growing Demand for IoT Applications

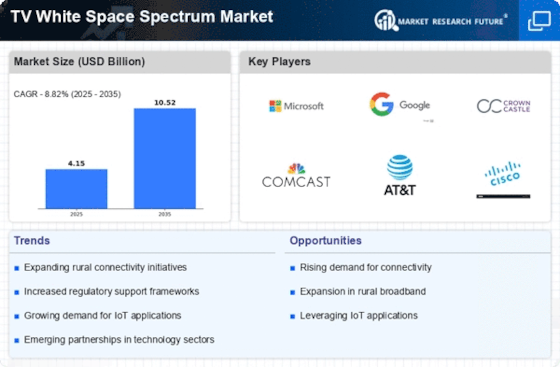

The TV White Space Spectrum Market is experiencing a surge in demand for Internet of Things (IoT) applications. As IoT devices proliferate, the need for reliable and extensive connectivity becomes paramount. TV white space technology offers a solution by providing wide-area coverage and the ability to connect multiple devices simultaneously. This is particularly beneficial for smart agriculture, environmental monitoring, and smart city initiatives, where connectivity is often a challenge. Market analysts project that the integration of TV white space technology in IoT applications could lead to a market expansion of approximately USD 800 million by 2027, underscoring the technology's potential in supporting the growing IoT ecosystem.

Increased Demand for Connectivity Solutions

The TV White Space Spectrum Market is experiencing heightened demand for connectivity solutions, particularly in underserved regions. As traditional broadband infrastructure often fails to reach remote areas, TV white space technology offers a viable alternative. This technology utilizes unused television frequencies to provide internet access, which is crucial for educational and economic development. Recent studies indicate that the market for TV white space technology could reach USD 1.5 billion by 2026, driven by the need for affordable and reliable internet access. The ability to penetrate obstacles and cover large areas makes this technology particularly appealing for rural deployments, thereby expanding the overall market potential.

Rising Interest from Educational Institutions

The TV White Space Spectrum Market is witnessing a rising interest from educational institutions seeking to enhance their connectivity. Schools and universities in remote areas are increasingly adopting TV white space technology to provide students with reliable internet access. This trend is particularly pronounced in regions where traditional broadband options are limited or non-existent. By leveraging TV white space, educational institutions can facilitate online learning and access to digital resources, thereby improving educational outcomes. As of 2025, it is estimated that over 30% of educational institutions in rural areas have implemented white space solutions, highlighting the technology's role in transforming education.

Technological Advancements in Spectrum Management

Technological advancements in spectrum management are propelling the TV White Space Spectrum Market forward. Innovations such as dynamic spectrum access and cognitive radio technologies enable more efficient use of available frequencies. These advancements allow for real-time monitoring and allocation of spectrum resources, which enhances the performance of white space devices. As a result, the market is likely to see an increase in the deployment of these technologies, with projections suggesting a compound annual growth rate of 20% over the next five years. This growth is indicative of the increasing reliance on sophisticated spectrum management solutions to optimize connectivity.