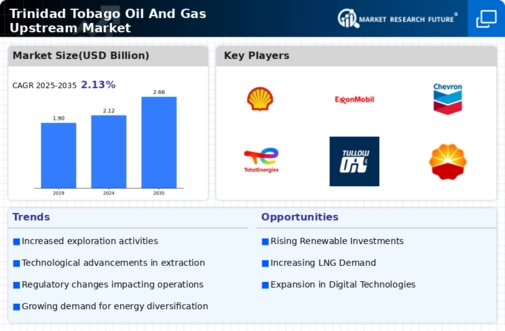

Increased Demand for Energy

The Trinidad Tobago Oil And Gas Upstream Market is currently experiencing a surge in energy demand, driven by both local and regional consumption needs. As economies in the Caribbean and South America continue to grow, the need for reliable energy sources becomes paramount. Trinidad and Tobago, with its established oil and gas reserves, is well-positioned to meet this demand. In 2025, the country is expected to produce approximately 60 million barrels of oil equivalent, indicating a robust capacity to supply energy. This increasing demand not only supports the upstream sector but also encourages further investment in exploration and production activities, thereby enhancing the overall market landscape.

Focus on Renewable Energy Integration

The Trinidad Tobago Oil And Gas Upstream Market is gradually shifting towards integrating renewable energy sources alongside traditional oil and gas operations. This trend is driven by a growing awareness of environmental sustainability and the need to diversify energy portfolios. In 2025, the government is expected to promote initiatives that encourage oil and gas companies to invest in renewable technologies, such as solar and wind energy. This integration not only helps in reducing carbon footprints but also positions Trinidad and Tobago as a forward-thinking player in the energy sector. The potential for hybrid energy solutions could redefine the upstream market landscape, attracting new investments and enhancing energy security.

Regulatory Support and Policy Framework

The Trinidad Tobago Oil And Gas Upstream Market benefits from a supportive regulatory environment that encourages investment and development. The government has implemented policies aimed at attracting foreign direct investment, which is crucial for the growth of the upstream sector. Recent initiatives include tax incentives and streamlined permitting processes, which have made it easier for companies to operate. In 2025, the government is expected to introduce additional measures to enhance operational efficiency and sustainability. This regulatory support is likely to foster a more competitive market, enabling Trinidad and Tobago to maintain its status as a key player in the oil and gas sector.

Technological Innovations in Exploration

Technological advancements are playing a pivotal role in the Trinidad Tobago Oil And Gas Upstream Market, particularly in exploration and production processes. The adoption of advanced seismic imaging and drilling technologies has significantly improved the efficiency of resource extraction. In 2025, companies are increasingly utilizing data analytics and artificial intelligence to optimize production and reduce operational costs. These innovations not only enhance recovery rates but also minimize environmental impacts, aligning with global sustainability trends. As technology continues to evolve, it is expected that Trinidad and Tobago will see a rise in exploration success rates, further solidifying its position in the upstream market.

Strategic Partnerships and Collaborations

Strategic partnerships are becoming increasingly vital in the Trinidad Tobago Oil And Gas Upstream Market. Collaborations between local companies and international firms are fostering knowledge transfer and resource sharing, which are essential for enhancing operational capabilities. In 2025, several joint ventures are anticipated to emerge, focusing on both exploration and production. These partnerships not only leverage the strengths of each entity but also mitigate risks associated with large-scale investments. By pooling resources and expertise, Trinidad and Tobago can enhance its competitiveness in the upstream sector, ensuring sustainable growth and development.