Growing Regulatory Requirements

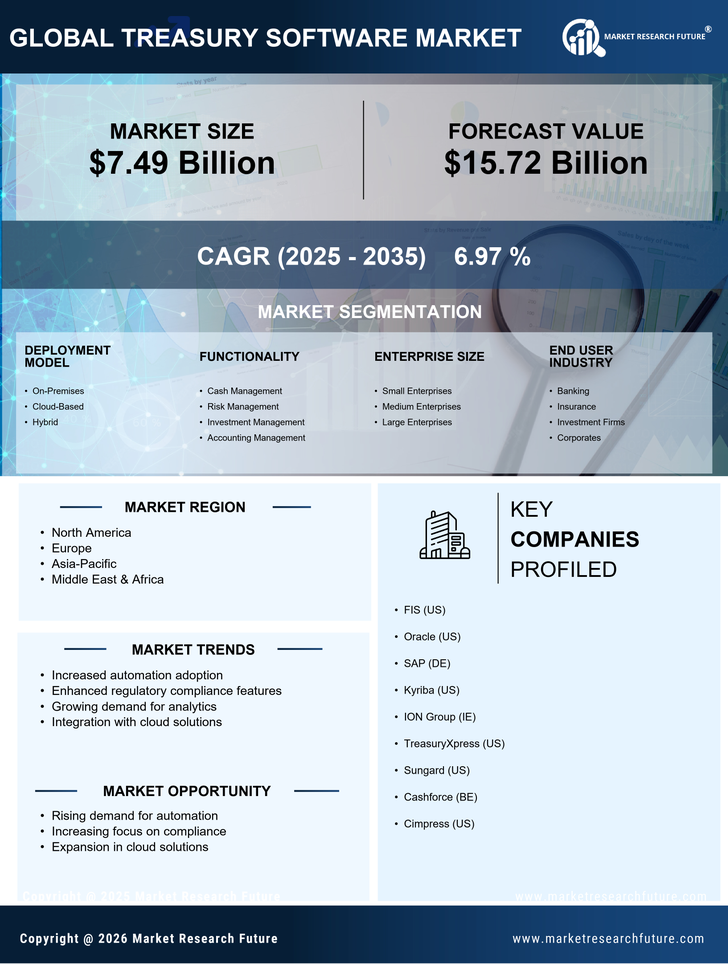

The Treasury Software Market is significantly influenced by the increasing regulatory requirements imposed on financial institutions. Compliance with regulations such as Anti-Money Laundering (AML) and Know Your Customer (KYC) necessitates robust treasury management systems that can ensure adherence to legal standards. Organizations are investing in software solutions that offer compliance tracking and reporting functionalities. The market for compliance-focused treasury software has expanded, with estimates indicating a growth rate of around 20% annually. This trend reflects the urgency for companies to mitigate compliance risks and avoid potential penalties. Consequently, the Treasury Software Market is adapting to provide tools that facilitate regulatory compliance while enhancing overall operational efficiency.

Increased Demand for Automation

The Treasury Software Market experiences a notable surge in demand for automation solutions. Organizations are increasingly seeking to streamline their treasury operations, reduce manual errors, and enhance efficiency. Automation tools facilitate real-time cash management, forecasting, and reporting, which are critical for informed decision-making. According to recent data, the adoption of automated treasury solutions has grown by approximately 25% over the past two years. This trend indicates a shift towards more sophisticated treasury management systems that can handle complex financial transactions with minimal human intervention. As companies strive to optimize their financial processes, the Treasury Software Market is likely to witness continued growth driven by the need for automation.

Rising Focus on Risk Management

In the Treasury Software Market, there is an increasing emphasis on risk management solutions. Organizations are recognizing the importance of identifying, assessing, and mitigating financial risks associated with currency fluctuations, interest rate changes, and liquidity challenges. The demand for treasury software that incorporates advanced risk analytics and scenario modeling is on the rise. Recent studies suggest that companies investing in risk management tools have seen a reduction in financial losses by up to 30%. This trend underscores the necessity for treasury departments to adopt comprehensive software solutions that not only manage cash flow but also provide insights into potential risks. As such, the Treasury Software Market is evolving to meet these critical needs.

Integration of Cloud-Based Solutions

The Treasury Software Market is experiencing a significant shift towards cloud-based treasury management solutions. Organizations are increasingly adopting cloud technology to enhance accessibility, scalability, and collaboration among treasury teams. Cloud-based software allows for real-time data sharing and integration with other financial systems, which is essential for effective cash management. Recent market analysis indicates that the adoption of cloud treasury solutions has increased by nearly 30% in the last year alone. This trend suggests that companies are prioritizing flexibility and cost-effectiveness in their treasury operations. As a result, the Treasury Software Market is likely to see continued growth driven by the transition to cloud-based platforms.

Demand for Enhanced Analytics and Reporting

The Treasury Software Market is witnessing a growing demand for enhanced analytics and reporting capabilities. Organizations are increasingly relying on data-driven insights to make informed financial decisions. Advanced treasury software solutions now offer sophisticated analytics tools that enable users to visualize cash flows, forecast future financial scenarios, and generate comprehensive reports. This shift towards data-centric treasury management is supported by the fact that companies utilizing advanced analytics have reported improved decision-making efficiency by approximately 40%. As businesses seek to leverage data for strategic advantage, the Treasury Software Market is likely to continue evolving, providing innovative solutions that cater to these analytical needs.