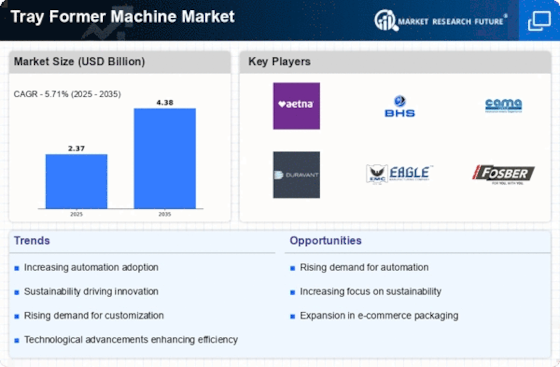

Rising E-commerce Demand

The Tray Former Machine Market is experiencing a notable surge due to the increasing demand for e-commerce packaging solutions. As online shopping continues to expand, the need for efficient and reliable packaging systems becomes paramount. E-commerce businesses require packaging that is not only cost-effective but also capable of protecting products during transit. This has led to a heightened interest in tray forming machines, which can produce customized trays that fit various product dimensions. According to recent data, the e-commerce sector is projected to grow at a compound annual growth rate of over 15%, further driving the demand for innovative packaging solutions. Consequently, manufacturers in the Tray Former Machine Market are focusing on enhancing their product offerings to cater to this growing segment.

Increased Focus on Automation

Automation is becoming a critical driver in the Tray Former Machine Market as manufacturers seek to improve efficiency and reduce labor costs. The integration of automated systems in packaging processes allows for faster production rates and minimizes human error. This trend is particularly evident in industries such as food and beverage, where speed and accuracy are essential. Recent statistics indicate that the automation market is expected to grow significantly, with many companies investing in advanced technologies to streamline their operations. As a result, the demand for automated tray forming machines is likely to rise, as businesses aim to enhance productivity while maintaining high-quality standards in their packaging solutions.

Technological Innovations in Machinery

Technological advancements are significantly shaping the Tray Former Machine Market, as manufacturers strive to enhance the performance and efficiency of their machines. Innovations such as improved automation, enhanced precision, and energy-efficient designs are becoming increasingly prevalent. These advancements not only improve production capabilities but also reduce operational costs for businesses. Recent reports indicate that the machinery sector is witnessing a rapid evolution, with companies investing in research and development to stay competitive. As a result, the demand for state-of-the-art tray forming machines is expected to grow, as businesses seek to leverage these technological innovations to optimize their packaging processes.

Sustainability and Eco-friendly Packaging

The Tray Former Machine Market is increasingly influenced by the growing emphasis on sustainability and eco-friendly packaging solutions. Consumers are becoming more environmentally conscious, prompting companies to adopt sustainable practices in their packaging processes. This shift has led to a demand for tray forming machines that can produce recyclable and biodegradable packaging materials. Recent data suggests that the market for sustainable packaging is expected to witness substantial growth, with many businesses prioritizing eco-friendly options. Consequently, manufacturers in the Tray Former Machine Market are innovating their technologies to accommodate these requirements, ensuring that their products align with the evolving preferences of consumers and regulatory standards.

Customization and Versatility in Packaging

Customization is a significant driver in the Tray Former Machine Market, as businesses seek to differentiate their products through unique packaging solutions. The ability to produce trays in various shapes, sizes, and designs allows companies to enhance their brand identity and appeal to consumers. This trend is particularly prevalent in sectors such as cosmetics and electronics, where packaging plays a crucial role in attracting customers. Market analysis indicates that the demand for customized packaging solutions is on the rise, with many companies investing in tray forming machines that offer flexibility and versatility. As a result, the Tray Former Machine Market is likely to see continued growth as manufacturers respond to the increasing need for tailored packaging options.