Regulatory Support

Regulatory support is a significant driver for the Transportation Composite Market. Governments worldwide are implementing stringent regulations aimed at reducing carbon emissions and promoting the use of lightweight materials in transportation. These regulations often incentivize manufacturers to adopt composite materials, which can lead to improved fuel efficiency and lower environmental impact. For example, policies that mandate emissions reductions are likely to encourage the adoption of composites in automotive and aerospace applications. As a result, the market is expected to witness a surge in demand for compliant materials, further propelling the growth of the composite sector.

Smart Mobility Integration

The integration of smart mobility solutions is emerging as a key driver in the Transportation Composite Market. As urbanization accelerates, there is a growing need for efficient and interconnected transportation systems. Composites are being utilized in the development of lightweight, durable components for electric vehicles and autonomous transport systems. This shift is expected to enhance the performance and safety of these vehicles, making them more appealing to consumers. Additionally, the rise of shared mobility services is likely to increase the demand for composite materials, as they contribute to the overall efficiency and sustainability of transportation networks.

Sustainability Initiatives

The Transportation Composite Market is experiencing a notable shift towards sustainability initiatives. As environmental concerns intensify, manufacturers are increasingly adopting composite materials that offer reduced weight and enhanced fuel efficiency. For instance, composites can lead to a 20-30% reduction in vehicle weight, which directly correlates with lower emissions and improved energy consumption. This trend is further supported by regulatory frameworks that encourage the use of eco-friendly materials. The demand for sustainable transportation solutions is likely to drive innovation in composite materials, fostering a competitive landscape where companies that prioritize sustainability may gain a significant market advantage.

Technological Advancements

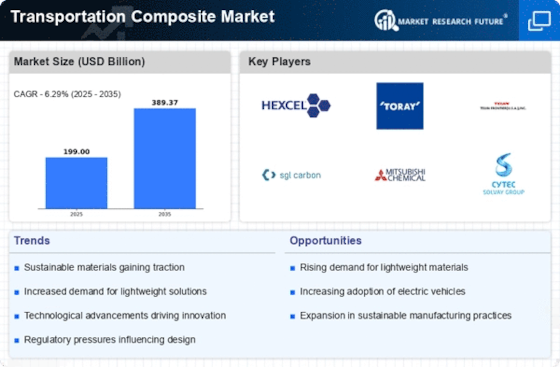

Technological advancements play a pivotal role in shaping the Transportation Composite Market. Innovations in manufacturing processes, such as automated fiber placement and 3D printing, are enhancing the efficiency and precision of composite production. These technologies not only reduce production costs but also enable the creation of complex geometries that were previously unattainable. Furthermore, the integration of smart materials that respond to environmental changes is gaining traction. As a result, the market is projected to grow at a compound annual growth rate of approximately 8% over the next five years, driven by the increasing adoption of advanced composites in various transportation applications.

Rising Demand for Lightweight Materials

The rising demand for lightweight materials is a crucial factor influencing the Transportation Composite Market. As fuel efficiency becomes a priority for manufacturers, the need for materials that reduce overall vehicle weight is paramount. Composites, known for their high strength-to-weight ratio, are increasingly being utilized in various transportation sectors, including automotive, aerospace, and marine. This trend is supported by data indicating that a reduction of just 10% in vehicle weight can lead to a 6-8% improvement in fuel economy. Consequently, the market for transportation composites is poised for growth as manufacturers seek to meet consumer expectations for performance and efficiency.