North America : Market Leader in MRO Services

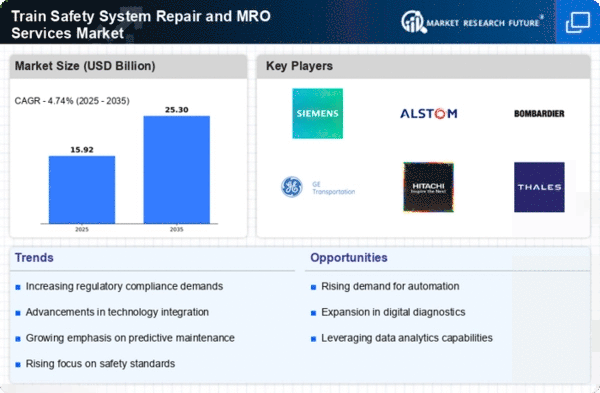

North America leads the Train Safety System Repair and MRO Services Market, holding a significant market share of 7.8 in 2024. The growth is driven by increasing investments in rail infrastructure, stringent safety regulations, and a rising demand for advanced safety technologies. Government initiatives aimed at enhancing rail safety and efficiency further catalyze market expansion, ensuring a robust demand for repair and maintenance services. The competitive landscape is characterized by major players such as GE Transportation, Siemens, and Bombardier, who are actively innovating to meet regulatory standards. The U.S. and Canada are the leading countries, with substantial investments in rail safety systems. The presence of established companies and ongoing collaborations with government bodies enhance the market's growth potential, positioning North America as a key player in the global landscape.

Europe : Emerging Market with Growth Potential

Europe's Train Safety System Repair and MRO Services Market is valued at 4.5, reflecting a growing emphasis on safety and compliance. The region benefits from stringent EU regulations that mandate regular maintenance and upgrades of rail systems, driving demand for MRO services. The push for sustainable transport solutions and modernization of aging infrastructure are key growth drivers, supported by government funding and initiatives aimed at enhancing rail safety. Leading countries in this market include Germany, France, and the UK, where companies like Alstom and Thales Group are prominent. The competitive landscape is evolving, with a focus on technological advancements and partnerships to meet regulatory requirements. The presence of established players and a collaborative approach with regulatory bodies position Europe as a significant market for train safety systems.

Asia-Pacific : Rapidly Growing Market Segment

The Asia-Pacific region, with a market size of 2.8, is witnessing rapid growth in the Train Safety System Repair and MRO Services Market. This growth is fueled by increasing urbanization, government investments in rail infrastructure, and a rising focus on safety standards. Countries like China and India are leading the charge, implementing extensive rail projects that necessitate robust MRO services to ensure safety and reliability in operations. China stands out as a key player, with significant investments in high-speed rail and safety technologies. The competitive landscape includes major companies like Hitachi Rail and Mitsubishi Electric, which are expanding their presence in the region. The growing demand for efficient rail systems and the need for compliance with safety regulations are driving the market forward, making Asia-Pacific a vital area for future growth.

Middle East and Africa : Emerging Market with Challenges

The Middle East and Africa region represents a nascent market for Train Safety System Repair and MRO Services, with a market size of only 0.1. The growth is hindered by limited rail infrastructure and investment in safety systems. However, there is a growing recognition of the importance of rail safety, driven by increasing urbanization and the need for efficient transport solutions. Governments are beginning to prioritize rail safety, which may catalyze future market growth. Countries like South Africa and the UAE are exploring opportunities to enhance their rail systems, but the competitive landscape remains underdeveloped. Key players are gradually entering the market, focusing on establishing partnerships and collaborations to improve safety standards. The potential for growth exists, but significant challenges remain in terms of investment and infrastructure development.