Urbanization and Population Growth

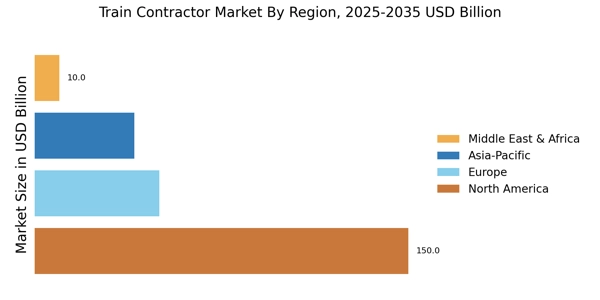

Urbanization and population growth are significant factors influencing the Train Contractor Market. As urban areas expand, the demand for efficient public transportation systems increases. This trend is particularly evident in densely populated regions where traffic congestion necessitates the development of robust rail networks. According to recent data, urban areas are projected to house over two-thirds of the world's population by 2050, leading to heightened investments in rail infrastructure. Consequently, contractors specializing in rail construction and maintenance are likely to experience increased opportunities as cities strive to enhance their public transport systems to accommodate growing populations.

Government Infrastructure Investments

Government infrastructure investments are a crucial driver for the Train Contractor Market. Many governments are recognizing the need to upgrade and expand their rail networks to support economic growth and improve connectivity. This recognition has led to the allocation of substantial budgets for rail projects, including high-speed rail lines and commuter rail systems. For example, recent reports indicate that several countries are planning to invest billions in rail infrastructure over the next decade. Such investments not only create jobs but also stimulate demand for contractors who can deliver these large-scale projects, thereby propelling the Train Contractor Market forward.

Sustainable Transportation Initiatives

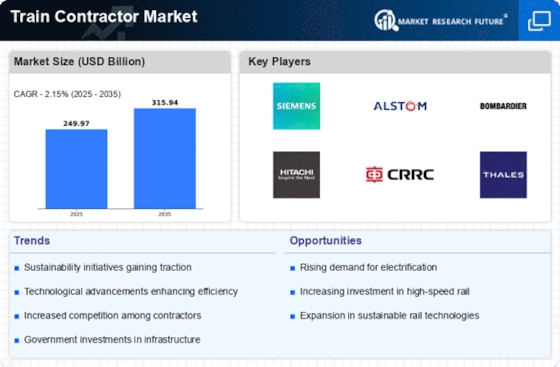

The increasing emphasis on sustainable transportation initiatives appears to be a pivotal driver for the Train Contractor Market. Governments and organizations are increasingly prioritizing eco-friendly solutions to reduce carbon emissions and promote energy efficiency. This trend is evidenced by the substantial investments in electrification of rail networks and the adoption of renewable energy sources. For instance, many countries are setting ambitious targets for reducing greenhouse gas emissions, which necessitates the modernization of rail infrastructure. The Train Contractor Market is likely to benefit from these initiatives as contractors are engaged to develop and implement sustainable rail solutions, thereby enhancing operational efficiency and reducing environmental impact.

Technological Advancements in Rail Systems

Technological advancements in rail systems are transforming the Train Contractor Market. Innovations such as automated train control systems, predictive maintenance technologies, and advanced signaling systems are becoming increasingly prevalent. These technologies not only enhance safety and efficiency but also reduce operational costs. The integration of Internet of Things (IoT) devices in rail systems allows for real-time monitoring and data analysis, which can lead to improved decision-making processes. As rail operators seek to modernize their fleets and infrastructure, the demand for contractors who can provide these advanced technological solutions is expected to rise, thereby driving growth in the Train Contractor Market.

Public-Private Partnerships in Rail Projects

Public-private partnerships (PPPs) are emerging as a vital driver for the Train Contractor Market. These collaborations between government entities and private companies facilitate the financing and execution of rail projects, allowing for shared risks and resources. PPPs can lead to more efficient project delivery and innovation, as private firms often bring expertise and capital to the table. The trend towards PPPs is likely to grow as governments seek to leverage private investment to meet their infrastructure needs. This shift presents opportunities for contractors who can navigate the complexities of such partnerships, thereby enhancing their role in the Train Contractor Market.