Growth in Chemical Manufacturing

The Global Toluene Market Industry is significantly influenced by the expansion of the chemical manufacturing sector. Toluene Market serves as a vital feedstock in the production of various chemicals, including benzene, xylene, and other aromatic compounds. As industries such as plastics, pharmaceuticals, and agrochemicals continue to grow, the demand for toluene is expected to increase correspondingly. The anticipated compound annual growth rate (CAGR) of 7.04% from 2025 to 2035 indicates a robust market trajectory, driven by the chemical sector's ongoing innovations and production enhancements. This growth underscores the essential role of toluene in the chemical manufacturing landscape.

Rising Demand in Automotive Sector

The Global Toluene Market Industry is experiencing a surge in demand driven by the automotive sector. Toluene Market is a critical solvent in the production of paints, coatings, and adhesives used in vehicle manufacturing. As the automotive industry continues to evolve, with an increasing focus on lightweight materials and advanced coatings, the need for high-quality toluene derivatives is likely to rise. In 2024, the market is projected to reach 20.3 USD Billion, reflecting the growing reliance on toluene in automotive applications. This trend suggests that the automotive sector will remain a pivotal driver for the Global Toluene Market Industry in the coming years.

Emerging Markets and Economic Growth

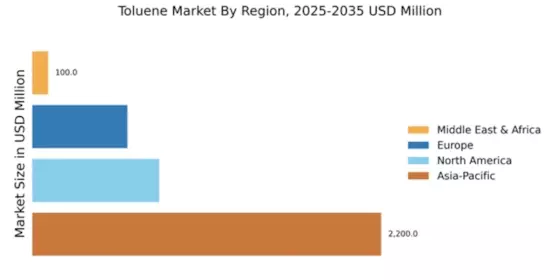

The Global Toluene Market Industry is benefiting from the economic growth of emerging markets, particularly in Asia-Pacific regions. Countries such as India and China are experiencing rapid industrialization, leading to increased demand for toluene in various applications, including solvents and chemical intermediates. As these economies continue to expand, the market is likely to see a significant uptick in consumption. The anticipated CAGR of 7.04% for 2025-2035 reflects the potential for growth driven by these emerging markets. This trend indicates that the Global Toluene Market Industry will increasingly rely on the economic dynamics of these regions to sustain its growth.

Increasing Use in Paints and Coatings

The Global Toluene Market Industry is witnessing heightened demand due to its extensive use in paints and coatings. Toluene Market is a key solvent that enhances the performance and application properties of various coatings, making it indispensable in the construction and automotive industries. With the global construction market projected to expand, the need for high-quality paints and coatings is likely to rise, further propelling toluene consumption. This trend is expected to contribute to the market's growth, with projections indicating a market value of 42.8 USD Billion by 2035. The increasing emphasis on aesthetic and protective coatings in various applications suggests a sustained demand for toluene.

Regulatory Changes and Environmental Considerations

The Global Toluene Market Industry is also shaped by evolving regulatory frameworks and environmental considerations. Stricter regulations regarding volatile organic compounds (VOCs) are prompting manufacturers to seek alternatives or modify their processes to comply with environmental standards. While this may pose challenges, it also presents opportunities for innovation in toluene applications. Companies are increasingly investing in research to develop more sustainable practices and products, which could reshape the market landscape. The ongoing dialogue around environmental sustainability suggests that the Global Toluene Market Industry will need to adapt to these changes to maintain its growth trajectory.